The Australian market has recently reached new heights, with the ASX 200 setting a record high driven by strong performances in the Energy, Technology, and Financial sectors. In such a robust market environment, investors often seek opportunities that combine affordability with growth potential. Penny stocks—though an older term—still hold relevance as they typically involve smaller or newer companies that can offer significant returns when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.64 | A$77.36M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.64 | A$122.15M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.58 | A$397.79M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.645 | A$434.95M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.99 | A$704.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.24 | A$753.01M | ✅ 4 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.845 | A$1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.72 | A$228.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.40 | A$161.33M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 1,004 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$828.61 million, focusing on managing a diversified portfolio.

Operations: The company generates revenue primarily from its portfolio of investments, totaling A$50.84 million.

Market Cap: A$828.61M

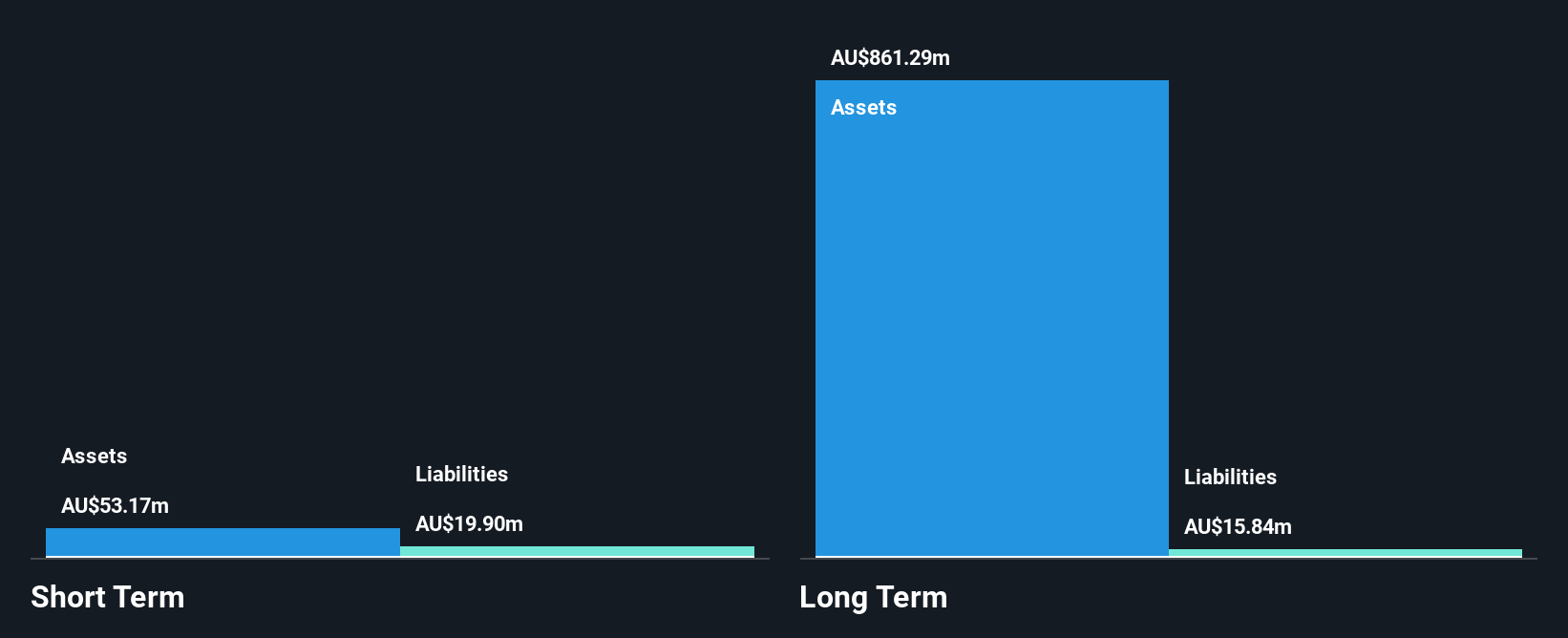

Djerriwarrh Investments Limited, with a market cap of A$828.61 million, has shown promising financial management and growth. The company's debt to equity ratio has significantly reduced over the past five years, indicating improved financial health. Its earnings have grown by 57.3% over the past year, outpacing both its historical average and the broader Capital Markets industry growth rate. Despite a low Return on Equity of 5.4%, Djerriwarrh's interest payments are well covered by EBIT, and it maintains high-quality earnings without recent shareholder dilution. However, its dividend yield of 4.84% is not fully supported by free cash flow.

- Jump into the full analysis health report here for a deeper understanding of Djerriwarrh Investments.

- Evaluate Djerriwarrh Investments' historical performance by accessing our past performance report.

MFF Capital Investments (ASX:MFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.55 billion.

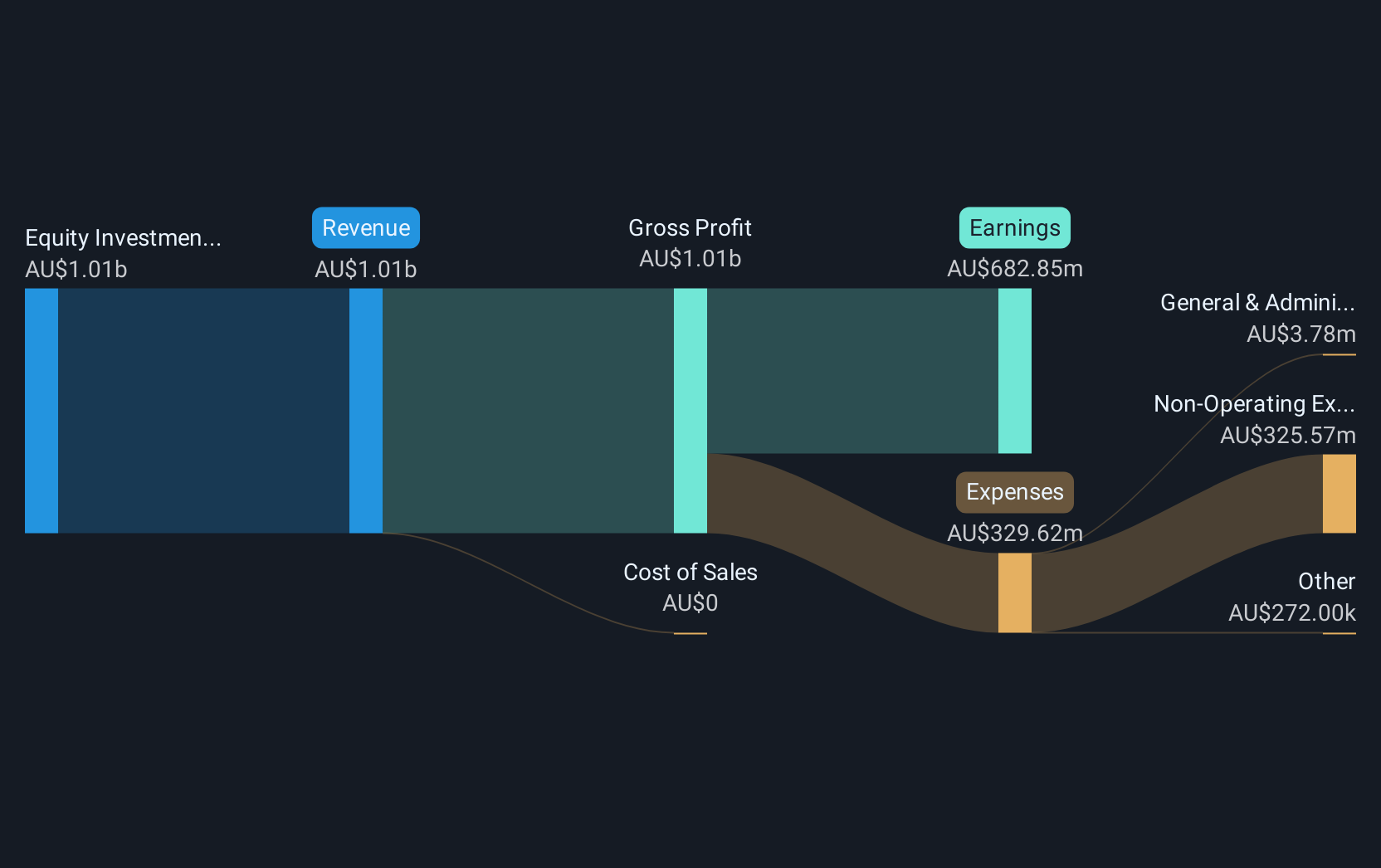

Operations: The firm generates revenue primarily through its equity investment segment, amounting to A$1.01 billion.

Market Cap: A$2.55B

MFF Capital Investments, with a market cap of A$2.55 billion, demonstrates robust financial health and growth potential. The firm's short-term assets significantly surpass both its short- and long-term liabilities, indicating strong liquidity. MFF's earnings have grown by 51.9% over the past year, outpacing the industry average and accelerating beyond its five-year growth rate of 31.3%. It offers a reliable dividend yield of 3.67% and maintains high-quality earnings without shareholder dilution in the past year. Additionally, MFF's debt is well covered by operating cash flow, reinforcing its financial stability despite an increase in debt-to-equity ratio over time.

- Click here to discover the nuances of MFF Capital Investments with our detailed analytical financial health report.

- Understand MFF Capital Investments' track record by examining our performance history report.

NobleOak Life (ASX:NOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NobleOak Life Limited, with a market cap of A$150.34 million, manufactures and distributes life insurance products in Australia.

Operations: The company generates revenue through three main segments: Genus (A$15.00 million), Direct (A$94.32 million), and Strategic Partnerships (A$280.57 million).

Market Cap: A$150.34M

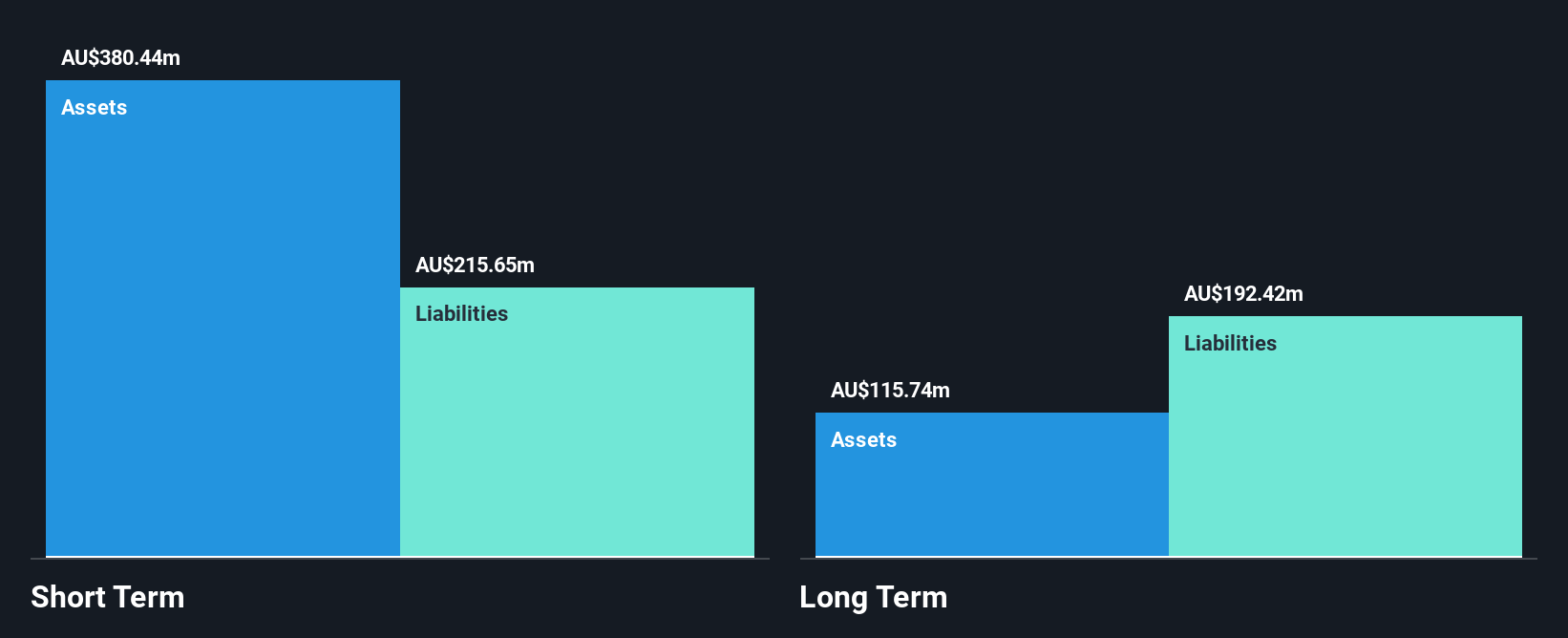

NobleOak Life Limited, with a market cap of A$150.34 million, shows promising growth in the penny stock segment due to its strong revenue streams across Genus, Direct, and Strategic Partnerships. The company has demonstrated significant earnings growth of 111.2% over the past year, surpassing industry averages and accelerating beyond its five-year average growth rate. NobleOak is debt-free with short-term assets exceeding liabilities, indicating solid financial health. Despite trading below estimated fair value by 21.9%, insider selling in recent months may warrant caution for potential investors considering this stock's volatility and investment risks.

- Take a closer look at NobleOak Life's potential here in our financial health report.

- Assess NobleOak Life's future earnings estimates with our detailed growth reports.

Next Steps

- Click through to start exploring the rest of the 1,001 ASX Penny Stocks now.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NobleOak Life might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NOL

NobleOak Life

Manufactures and distributes life insurance products in Australia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives