- China

- /

- Food and Staples Retail

- /

- SZSE:301078

Asian Stocks Trading Below Estimated Value July 2025

Reviewed by Simply Wall St

As global markets react positively to recent trade deals, Asian stocks are capturing attention with promising developments in China and Japan. Amid this backdrop, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.21 | CN¥27.87 | 49% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.04 | CN¥309.43 | 49.9% |

| SpiderPlus (TSE:4192) | ¥506.00 | ¥993.77 | 49.1% |

| Polaris Holdings (TSE:3010) | ¥220.00 | ¥433.42 | 49.2% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩139900.00 | ₩277418.79 | 49.6% |

| Hibino (TSE:2469) | ¥2370.00 | ¥4686.23 | 49.4% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥40.40 | CN¥78.51 | 48.5% |

| GEM (SZSE:002340) | CN¥6.69 | CN¥13.14 | 49.1% |

| Fositek (TWSE:6805) | NT$883.00 | NT$1737.53 | 49.2% |

| cottaLTD (TSE:3359) | ¥435.00 | ¥852.54 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Arashi Vision (SHSE:688775)

Overview: Arashi Vision Inc., operating as Insta360, develops and manufactures spherical video cameras with a market cap of CN¥65.83 billion.

Operations: The company's revenue segments are not provided in the given text.

Estimated Discount To Fair Value: 15.6%

Arashi Vision is trading at CN¥164.17, below its estimated fair value of CN¥194.58, suggesting potential undervaluation based on cash flows. Despite high earnings growth forecasts of 31.5% annually over three years and revenue growth projected at 24.1%, the company faces a highly volatile share price and non-cash earnings issues. Recent legal victories against GoPro and product innovations like Insta360 X5 enhancements could bolster future performance, while an IPO raised CN¥1.94 billion for expansion efforts.

- Our growth report here indicates Arashi Vision may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Arashi Vision.

Electric Connector Technology (SZSE:300679)

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system products globally, with a market cap of CN¥19.40 billion.

Operations: Electric Connector Technology Co., Ltd. generates revenue through the production and sale of micro electronic connectors and interconnection system products across China, North America, Europe, Japan, Asia Pacific, and other international markets.

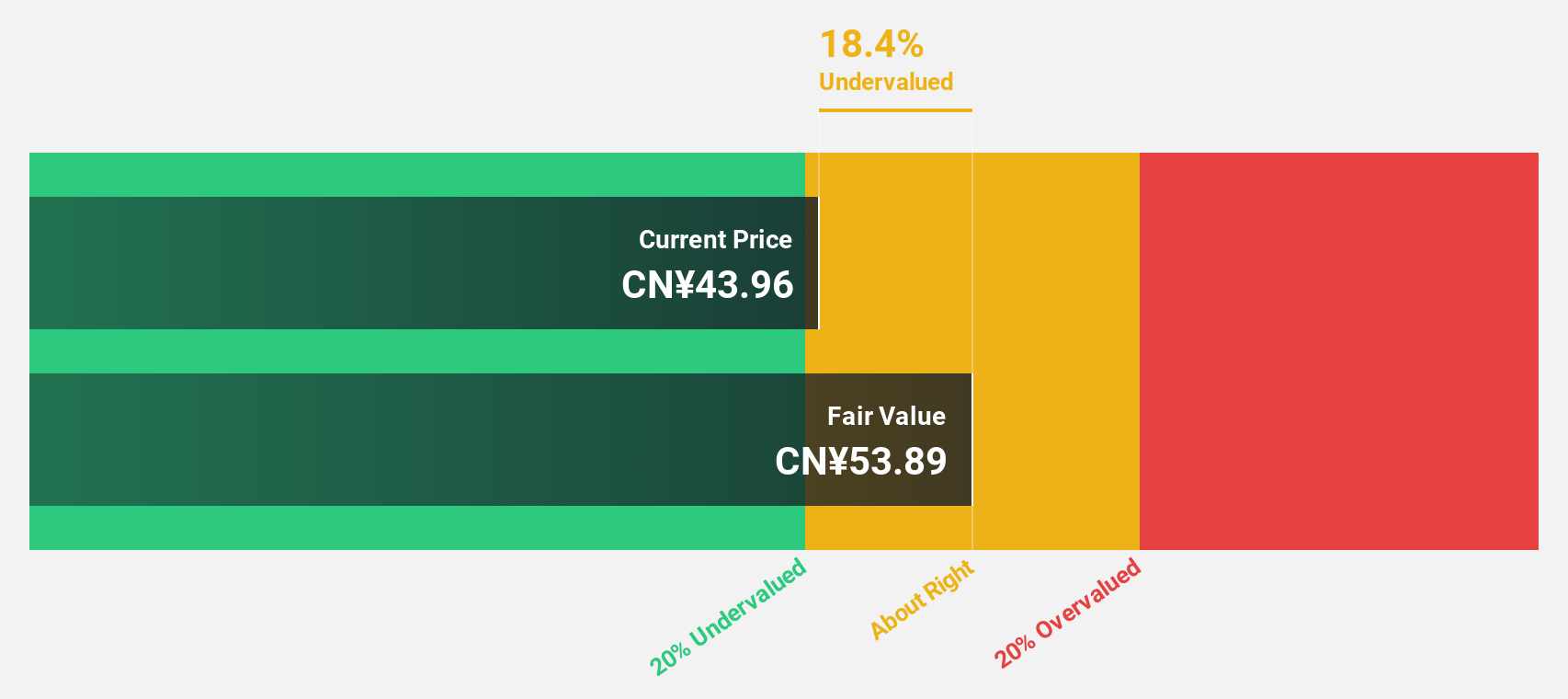

Estimated Discount To Fair Value: 13.6%

Electric Connector Technology, trading at CN¥46.31, is slightly undervalued with a fair value estimate of CN¥53.61. The company has an unstable dividend track record but recently increased dividends, reflecting improved cash flow management. Forecasts indicate robust annual earnings growth of 26.1% and revenue growth of 22.1%, both outpacing the Chinese market averages. Despite low future return on equity projections, its current valuation presents a good relative value compared to peers and industry standards.

- According our earnings growth report, there's an indication that Electric Connector Technology might be ready to expand.

- Take a closer look at Electric Connector Technology's balance sheet health here in our report.

Kidswant Children ProductsLtd (SZSE:301078)

Overview: Kidswant Children Products Co., Ltd. operates in China, focusing on the retail of maternal, infant, and child products with a market cap of CN¥16.77 billion.

Operations: The company generates revenue primarily from the retailing of mother and baby products, amounting to CN¥9.55 billion.

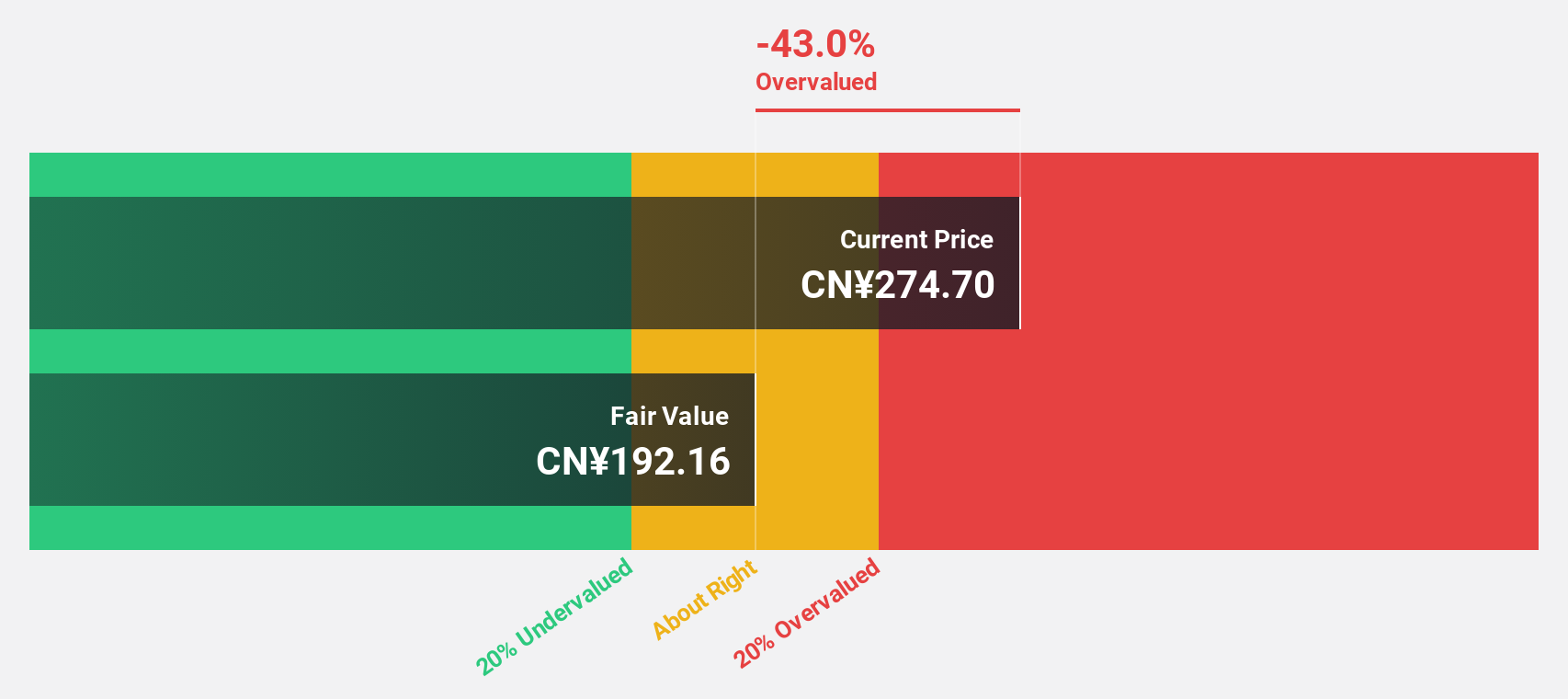

Estimated Discount To Fair Value: 26%

Kidswant Children Products Ltd., trading at CN¥13.39, is significantly undervalued with a fair value estimate of CN¥18.11. The company's earnings are projected to grow 36.4% annually, surpassing the Chinese market average of 23.5%, although revenue growth is slower at 18.4%. Despite low future return on equity and an unstable dividend history, recent inclusion in the Shenzhen Stock Exchange Component Index highlights its improving market position and potential for value appreciation.

- The analysis detailed in our Kidswant Children ProductsLtd growth report hints at robust future financial performance.

- Get an in-depth perspective on Kidswant Children ProductsLtd's balance sheet by reading our health report here.

Key Takeaways

- Gain an insight into the universe of 261 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kidswant Children ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301078

Kidswant Children ProductsLtd

Engages in the retail of maternal, infant, and child products in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives