- China

- /

- Commercial Services

- /

- SZSE:002266

Asian Market Insights: Jinhai Medical Technology Leads 3 Compelling Penny Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the U.S. and China agreeing to a temporary trade truce and Japan's stock markets reaching new highs, investors are keenly observing opportunities in the Asian market. Penny stocks, though often considered a relic of past market eras, remain relevant for those seeking growth potential at lower price points. In this article, we explore how these smaller or newer companies can offer surprising value when backed by strong financial fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.98 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.74 | THB2.94B | ✅ 5 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.04 | HK$2.8B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.44 | THB8.97B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company offering minimally invasive surgery solutions and medical products in China and Singapore, with a market cap of HK$5.92 billion.

Operations: The company's revenue is derived from Singapore (SGD 14.82 million) and The People's Republic of China (SGD 19.83 million).

Market Cap: HK$5.92B

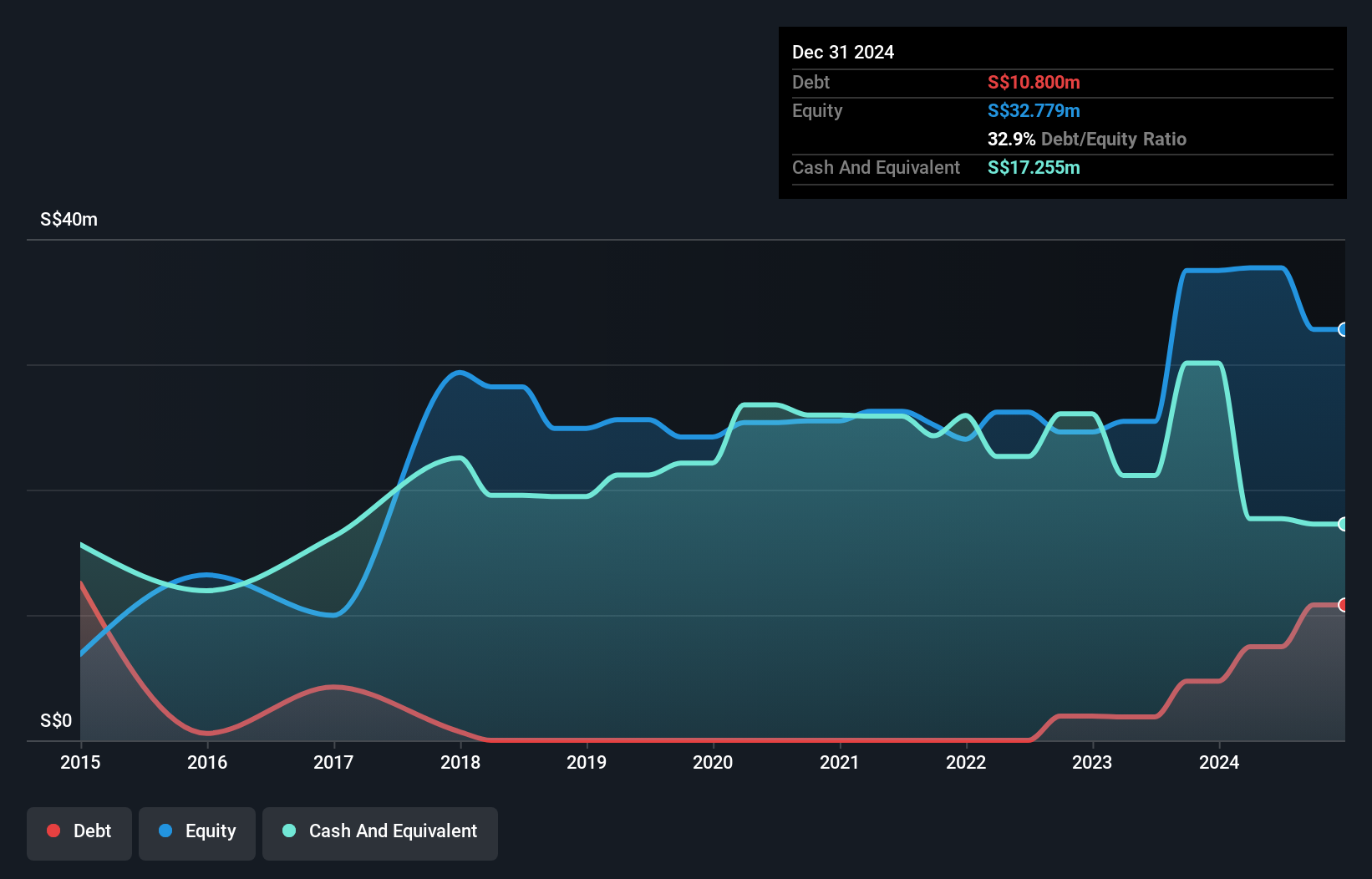

Jinhai Medical Technology faces challenges typical of penny stocks, with a significant net loss and declining revenues, reporting sales of SGD 14.53 million for the first half of 2025—a drop from the previous year. Despite this, its short-term assets exceed liabilities, and it has managed to avoid shareholder dilution over the past year. The company's recent inclusion in the S&P Global BMI Index may enhance visibility. However, high volatility and an increased debt-to-equity ratio highlight financial risks. Leadership changes could impact strategic direction as Mr. Wong Man Yiu steps in as company secretary amidst ongoing financial restructuring efforts.

- Dive into the specifics of Jinhai Medical Technology here with our thorough balance sheet health report.

- Explore historical data to track Jinhai Medical Technology's performance over time in our past results report.

Hong Kong Robotics Group Holding (SEHK:370)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Kong Robotics Group Holding Limited is an investment holding company that trades electronic appliances in the People’s Republic of China, Singapore, and Hong Kong, with a market cap of HK$2.28 billion.

Operations: The company generates revenue from several segments including Building Construction Contracting (HK$72.24 million), Geothermal Energy (HK$11.43 million), Customised Technical Support (HK$11.11 million), Centralised Heating (HK$9.95 million), Property Investment (HK$6.28 million), and Money Lending (HK$5.08 million).

Market Cap: HK$2.28B

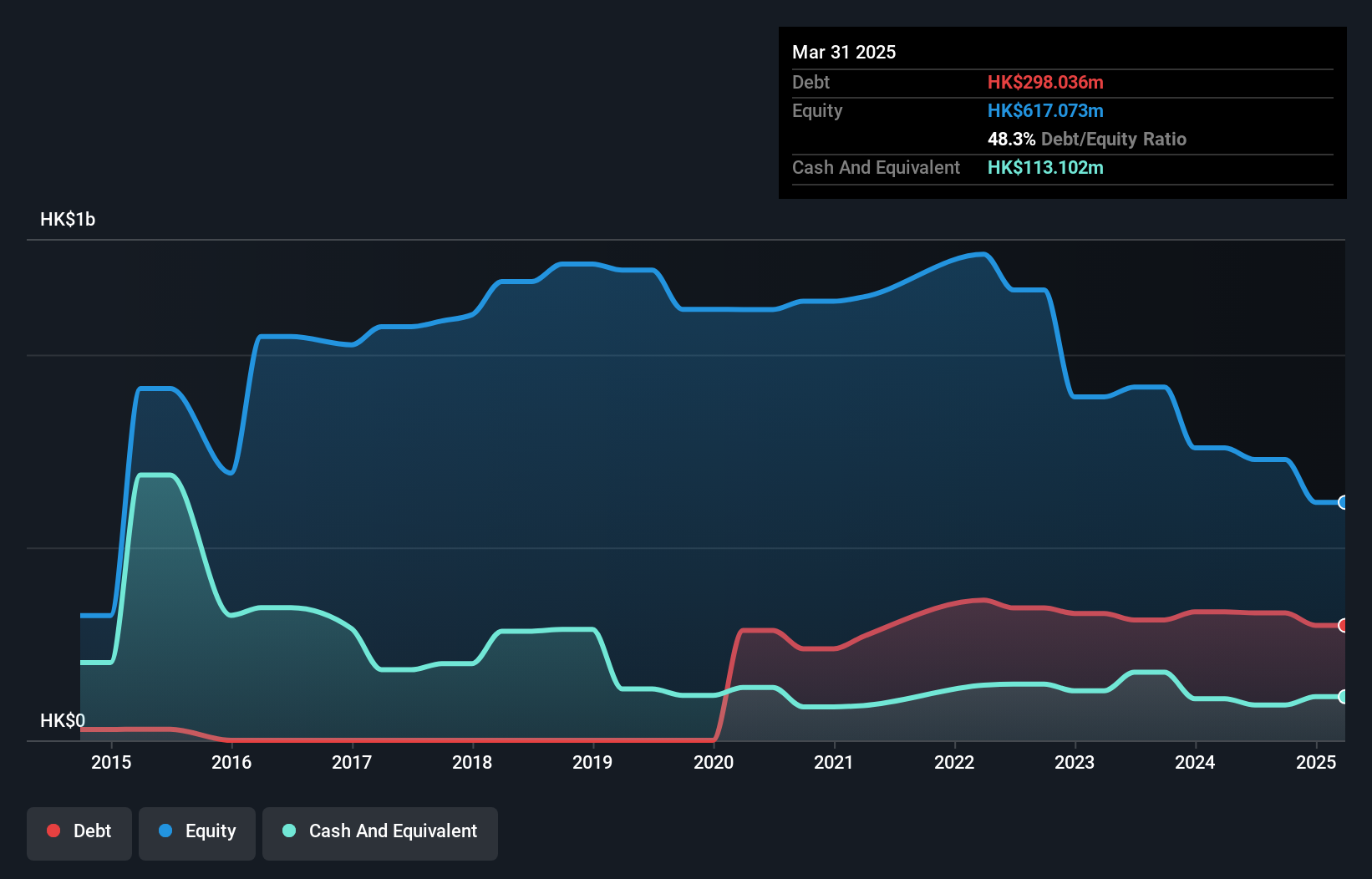

Hong Kong Robotics Group Holding Limited, with a market cap of HK$2.28 billion, faces typical challenges associated with penny stocks. Despite being unprofitable and experiencing a 16.2% annual decline in earnings over the past five years, the company maintains a positive cash flow and sufficient cash runway for over three years. Recent executive changes include Mr. Li Haitao's appointment as CEO and Mr. Huang William Xiao-qing as Chief Scientist, potentially steering strategic innovation in robotics technology. The company's short-term assets comfortably cover its liabilities, but an increased debt-to-equity ratio signals financial caution amidst ongoing restructuring efforts.

- Take a closer look at Hong Kong Robotics Group Holding's potential here in our financial health report.

- Gain insights into Hong Kong Robotics Group Holding's past trends and performance with our report on the company's historical track record.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhefu Holding Group Co., Ltd. manufactures hydropower equipment through its subsidiaries, serving both domestic and international markets, with a market cap of CN¥23.34 billion.

Operations: There are no specific revenue segments reported for Zhefu Holding Group.

Market Cap: CN¥23.34B

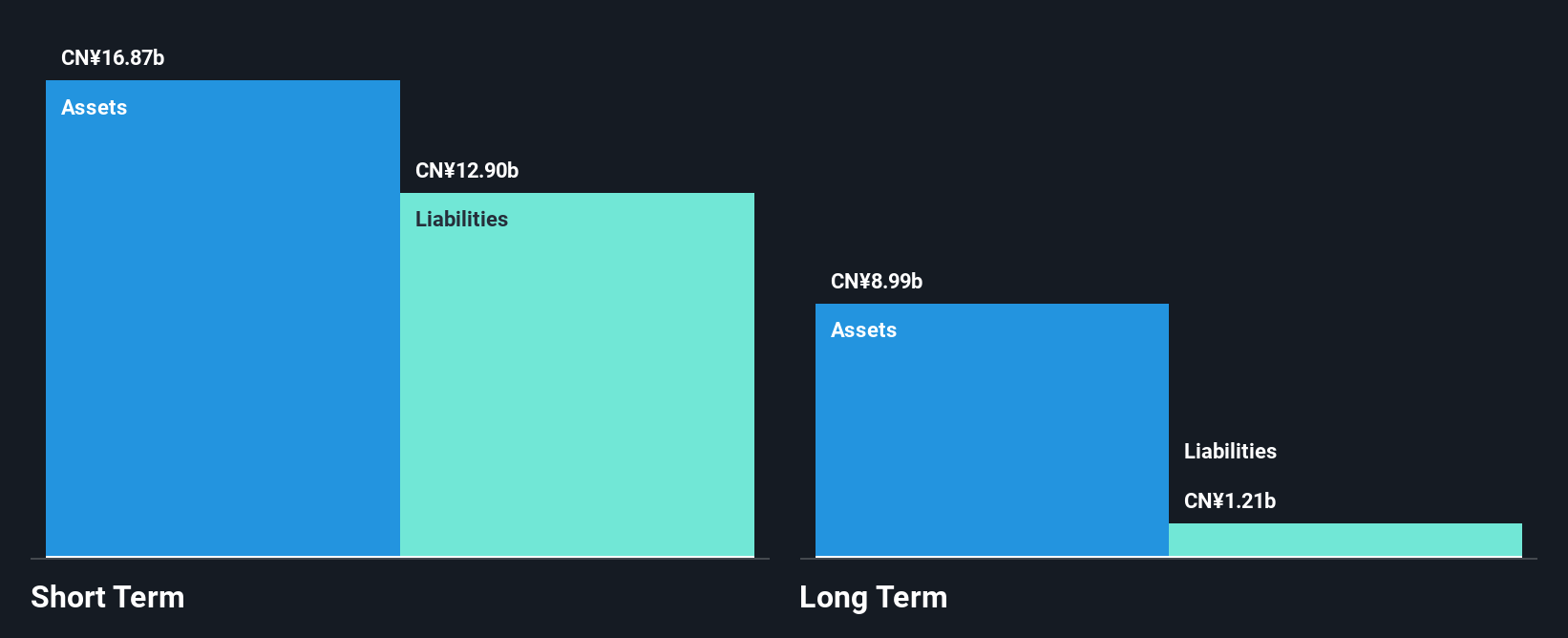

Zhefu Holding Group, with a market cap of CN¥23.34 billion, presents both opportunities and challenges typical of penny stocks. The company reported revenue growth to CN¥16.15 billion for the first nine months of 2025, though net income slightly declined to CN¥738.79 million compared to last year. Its earnings growth outpaces industry averages, yet profit margins remain modest at 4.3%. While its debt-to-equity ratio has improved over five years and interest coverage is robust at 25.5 times EBIT, cash flow struggles to cover debt effectively, indicating potential liquidity concerns despite stable short-term asset coverage.

- Jump into the full analysis health report here for a deeper understanding of Zhefu Holding Group.

- Gain insights into Zhefu Holding Group's future direction by reviewing our growth report.

Next Steps

- Explore the 955 names from our Asian Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhefu Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002266

Zhefu Holding Group

Through its subsidiaries, engages in manufacturing of hydropower equipment in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives