Stock Analysis

Zepp Health Corporation (NYSE:ZEPP) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, Zepp Health Corporation (NYSE:ZEPP) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

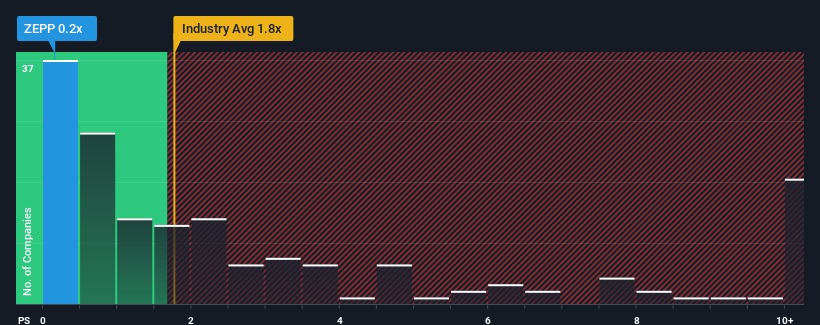

Following the heavy fall in price, Zepp Health may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Electronic industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Zepp Health

What Does Zepp Health's P/S Mean For Shareholders?

Zepp Health has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zepp Health.Is There Any Revenue Growth Forecasted For Zepp Health?

In order to justify its P/S ratio, Zepp Health would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 40%. This means it has also seen a slide in revenue over the longer-term as revenue is down 61% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 7.8% during the coming year according to the dual analysts following the company. That's not great when the rest of the industry is expected to grow by 2.9%.

With this information, we are not surprised that Zepp Health is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Zepp Health's P/S Mean For Investors?

The southerly movements of Zepp Health's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Zepp Health maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Zepp Health has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Zepp Health is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:ZEPP

Zepp Health

Zepp Health Corporation operates as a smart wearable and health technology company worldwide.

Adequate balance sheet and fair value.