Stock Analysis

- Chile

- /

- Real Estate

- /

- SNSE:PARAUCO

With EPS Growth And More, Parque Arauco (SNSE:PARAUCO) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Parque Arauco (SNSE:PARAUCO). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Parque Arauco

How Fast Is Parque Arauco Growing Its Earnings Per Share?

In the last three years Parque Arauco's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Parque Arauco boosted its trailing twelve month EPS from CL$112 to CL$124, in the last year. That's a 11% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Parque Arauco's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Parque Arauco maintained stable EBIT margins over the last year, all while growing revenue 13% to CL$284b. That's encouraging news for the company!

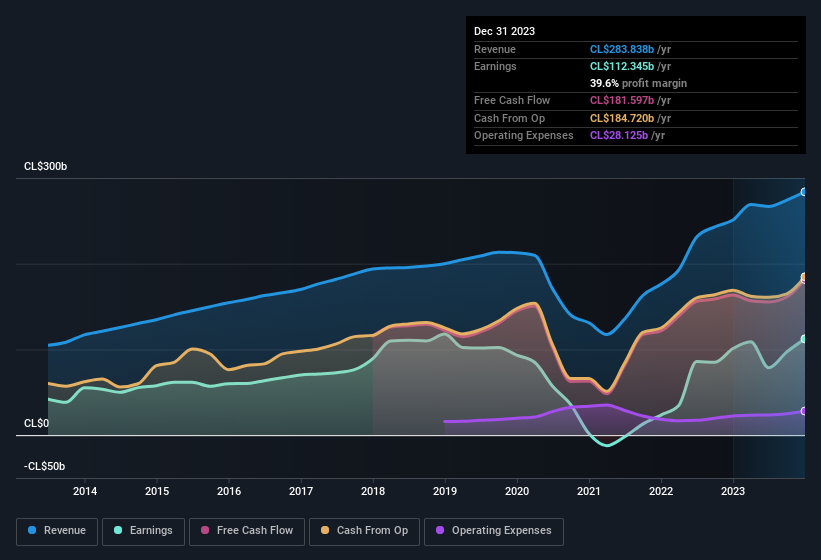

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Parque Arauco's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Parque Arauco Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Parque Arauco followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CL$40b. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Parque Arauco Deserve A Spot On Your Watchlist?

One positive for Parque Arauco is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. What about risks? Every company has them, and we've spotted 2 warning signs for Parque Arauco (of which 1 can't be ignored!) you should know about.

Although Parque Arauco certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Chilean companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Parque Arauco is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:PARAUCO

Parque Arauco

Parque Arauco S.A., together with its subsidiaries, develops, owns, operates, and manages multi-format real estate assets in Chile, Peru, and Colombia.

Mediocre balance sheet and slightly overvalued.