Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:LTTS

With EPS Growth And More, L&T Technology Services (NSE:LTTS) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like L&T Technology Services (NSE:LTTS). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for L&T Technology Services

How Quickly Is L&T Technology Services Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that L&T Technology Services' EPS has grown 23% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

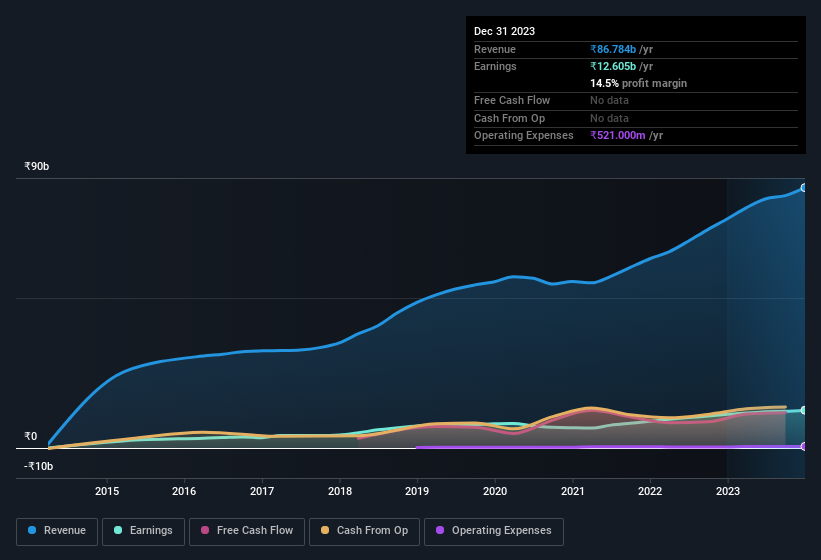

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note L&T Technology Services achieved similar EBIT margins to last year, revenue grew by a solid 14% to ₹87b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of L&T Technology Services' forecast profits?

Are L&T Technology Services Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹598b company like L&T Technology Services. But we are reassured by the fact they have invested in the company. To be specific, they have ₹4.1b worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does L&T Technology Services Deserve A Spot On Your Watchlist?

You can't deny that L&T Technology Services has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Even so, be aware that L&T Technology Services is showing 2 warning signs in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether L&T Technology Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:LTTS

L&T Technology Services

L&T Technology Services Limited operates as an engineering research and development services company in India, North America, Europe, and internationally.

Flawless balance sheet with moderate growth potential.