Stock Analysis

- United States

- /

- Building

- /

- NasdaqCM:JCTC.F

Why Investors Shouldn't Be Surprised By Jewett-Cameron Trading Company Ltd.'s (NASDAQ:JCTC.F) Low P/S

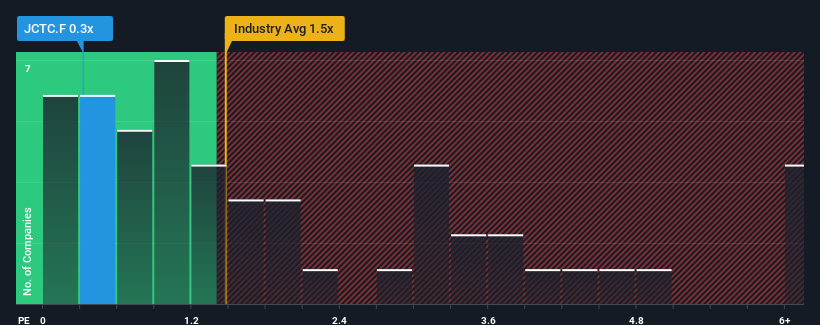

Jewett-Cameron Trading Company Ltd.'s (NASDAQ:JCTC.F) price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Building industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Jewett-Cameron Trading

What Does Jewett-Cameron Trading's Recent Performance Look Like?

For example, consider that Jewett-Cameron Trading's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Jewett-Cameron Trading will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Jewett-Cameron Trading, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Jewett-Cameron Trading's Revenue Growth Trending?

Jewett-Cameron Trading's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 8.9% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 6.9% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Jewett-Cameron Trading's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Jewett-Cameron Trading's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Jewett-Cameron Trading maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Jewett-Cameron Trading (1 is potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Jewett-Cameron Trading is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NasdaqCM:JCTC.F

Jewett-Cameron Trading

Jewett-Cameron Trading Company Ltd., through its subsidiaries, engages in the manufacturing and distribution of specialty metal products and wholesale distribution of wood products to home centers, eCommerce providers, on-line direct consumers, and other retailers.

Flawless balance sheet and good value.