Stock Analysis

- Norway

- /

- Electric Utilities

- /

- OB:ELMRA

We Think Elmera Group ASA's (OB:ELMRA) CEO Compensation Package Needs To Be Put Under A Microscope

Key Insights

- Elmera Group will host its Annual General Meeting on 24th of April

- CEO Rolf Barmen's total compensation includes salary of kr3.48m

- Total compensation is 355% above industry average

- Elmera Group's EPS declined by 22% over the past three years while total shareholder loss over the past three years was 34%

The results at Elmera Group ASA (OB:ELMRA) have been quite disappointing recently and CEO Rolf Barmen bears some responsibility for this. At the upcoming AGM on 24th of April, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Elmera Group

Comparing Elmera Group ASA's CEO Compensation With The Industry

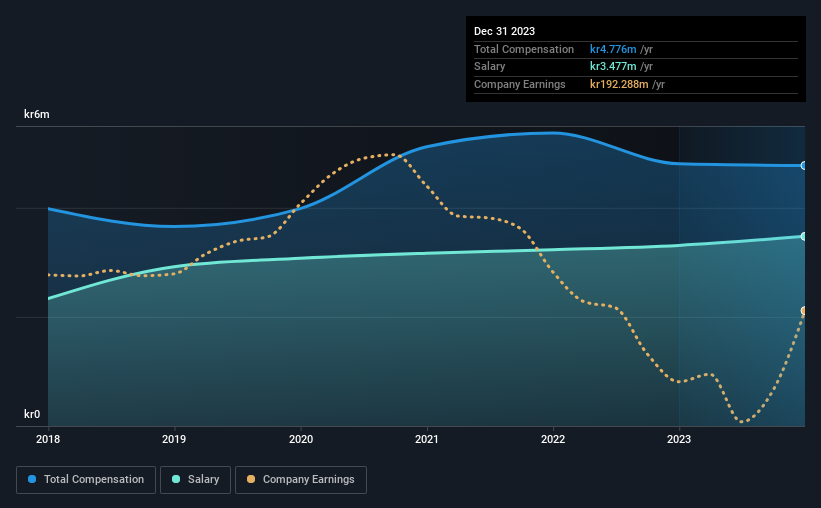

At the time of writing, our data shows that Elmera Group ASA has a market capitalization of kr3.6b, and reported total annual CEO compensation of kr4.8m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at kr3.48m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Norway Electric Utilities industry with market capitalizations between kr2.2b and kr8.8b, we discovered that the median CEO total compensation of that group was kr1.1m. This suggests that Rolf Barmen is paid more than the median for the industry. What's more, Rolf Barmen holds kr2.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr3.5m | kr3.3m | 73% |

| Other | kr1.3m | kr1.5m | 27% |

| Total Compensation | kr4.8m | kr4.8m | 100% |

On an industry level, around 60% of total compensation represents salary and 40% is other remuneration. According to our research, Elmera Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Elmera Group ASA's Growth Numbers

Over the last three years, Elmera Group ASA has shrunk its earnings per share by 22% per year. It saw its revenue drop 26% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Elmera Group ASA Been A Good Investment?

The return of -34% over three years would not have pleased Elmera Group ASA shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Elmera Group that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're helping make it simple.

Find out whether Elmera Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ELMRA

Elmera Group

Elmera Group ASA, together with its subsidiaries, engages in the purchase, sale, and portfolio management of electrical power to households, private and public companies, and municipalities in Norway.

Proven track record and fair value.