Stock Analysis

- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

We Think Cellnex Telecom (BME:CLNX) Is Taking Some Risk With Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Cellnex Telecom, S.A. (BME:CLNX) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Cellnex Telecom

How Much Debt Does Cellnex Telecom Carry?

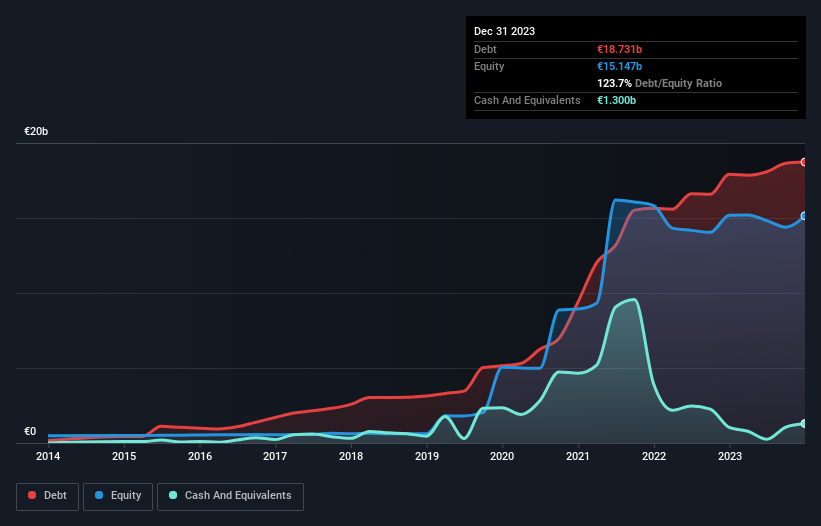

You can click the graphic below for the historical numbers, but it shows that as of December 2023 Cellnex Telecom had €18.7b of debt, an increase on €17.9b, over one year. However, because it has a cash reserve of €1.30b, its net debt is less, at about €17.4b.

How Strong Is Cellnex Telecom's Balance Sheet?

According to the last reported balance sheet, Cellnex Telecom had liabilities of €3.53b due within 12 months, and liabilities of €25.7b due beyond 12 months. Offsetting these obligations, it had cash of €1.30b as well as receivables valued at €1.16b due within 12 months. So it has liabilities totalling €26.8b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's huge €23.6b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Cellnex Telecom shareholders face the double whammy of a high net debt to EBITDA ratio (7.6), and fairly weak interest coverage, since EBIT is just 0.60 times the interest expense. This means we'd consider it to have a heavy debt load. The good news is that Cellnex Telecom grew its EBIT a smooth 76% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Cellnex Telecom's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Cellnex Telecom saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Cellnex Telecom's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at growing its EBIT; that's encouraging. We're quite clear that we consider Cellnex Telecom to be really rather risky, as a result of its balance sheet health. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Even though Cellnex Telecom lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether Cellnex Telecom is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:CLNX

Cellnex Telecom

Cellnex Telecom, S.A. operates infrastructure for wireless telecommunication in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Reasonable growth potential with mediocre balance sheet.