Stock Analysis

- United Kingdom

- /

- Retail Distributors

- /

- LSE:ULTP

Ultimate Products' (LON:ULTP) Earnings Offer More Than Meets The Eye

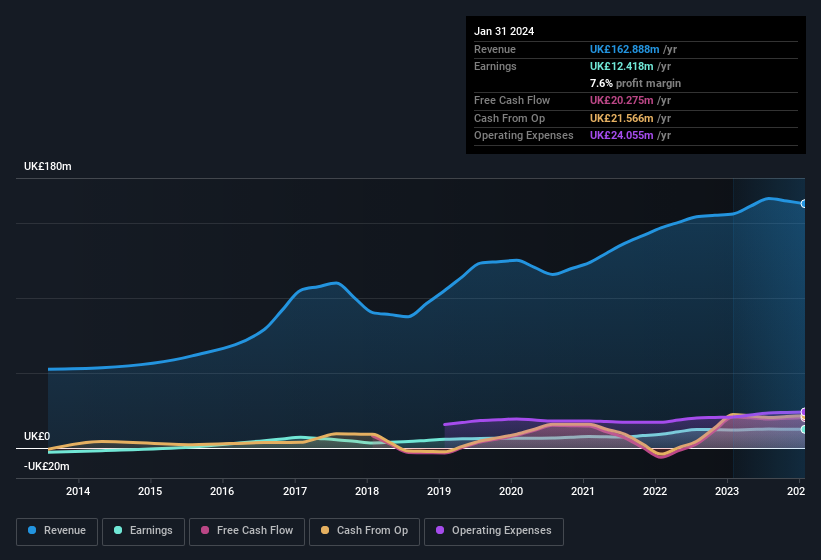

Ultimate Products Plc (LON:ULTP) announced a healthy earnings result recently, and the market rewarded it with a strong uplift in the stock price. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

See our latest analysis for Ultimate Products

Examining Cashflow Against Ultimate Products' Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to January 2024, Ultimate Products had an accrual ratio of -0.13. Therefore, its statutory earnings were quite a lot less than its free cashflow. To wit, it produced free cash flow of UK£20m during the period, dwarfing its reported profit of UK£12.4m. Ultimate Products did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Ultimate Products' Profit Performance

Ultimate Products' accrual ratio is solid, and indicates strong free cash flow, as we discussed, above. Based on this observation, we consider it likely that Ultimate Products' statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at 47% per year over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 2 warning signs for Ultimate Products and you'll want to know about them.

This note has only looked at a single factor that sheds light on the nature of Ultimate Products' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're helping make it simple.

Find out whether Ultimate Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:ULTP

Ultimate Products

Ultimate Products Plc, together with its subsidiaries, supplies branded homeware products in the United Kingdom, Germany, Rest of Europe, and internationally.

Flawless balance sheet and good value.