Stock Analysis

- India

- /

- Electrical

- /

- NSEI:VOLTAMP

There's Reason For Concern Over Voltamp Transformers Limited's (NSE:VOLTAMP) Massive 34% Price Jump

Voltamp Transformers Limited (NSE:VOLTAMP) shares have continued their recent momentum with a 34% gain in the last month alone. The annual gain comes to 258% following the latest surge, making investors sit up and take notice.

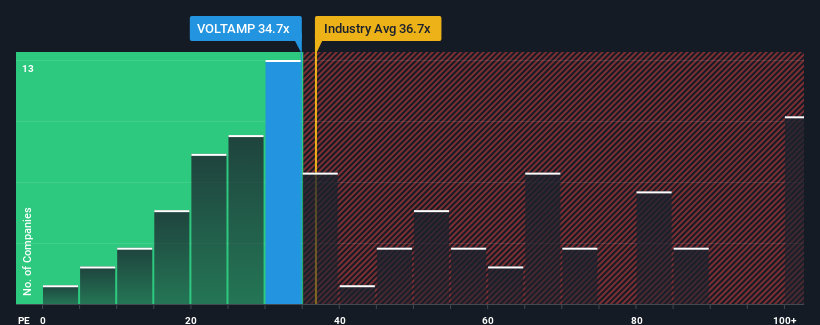

After such a large jump in price, Voltamp Transformers' price-to-earnings (or "P/E") ratio of 34.7x might make it look like a sell right now compared to the market in India, where around half of the companies have P/E ratios below 31x and even P/E's below 17x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Voltamp Transformers as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Voltamp Transformers

Is There Enough Growth For Voltamp Transformers?

There's an inherent assumption that a company should outperform the market for P/E ratios like Voltamp Transformers' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 66%. Pleasingly, EPS has also lifted 213% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 1.3% over the next year. With the market predicted to deliver 24% growth , that's a disappointing outcome.

With this information, we find it concerning that Voltamp Transformers is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Final Word

Voltamp Transformers' P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Voltamp Transformers' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Voltamp Transformers with six simple checks.

If you're unsure about the strength of Voltamp Transformers' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Voltamp Transformers is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:VOLTAMP

Voltamp Transformers

Voltamp Transformers Limited manufactures and sells various electrical transformers.

Outstanding track record with excellent balance sheet and pays a dividend.