Stock Analysis

Those holding INTERSHOP Communications Aktiengesellschaft (ETR:ISHA) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

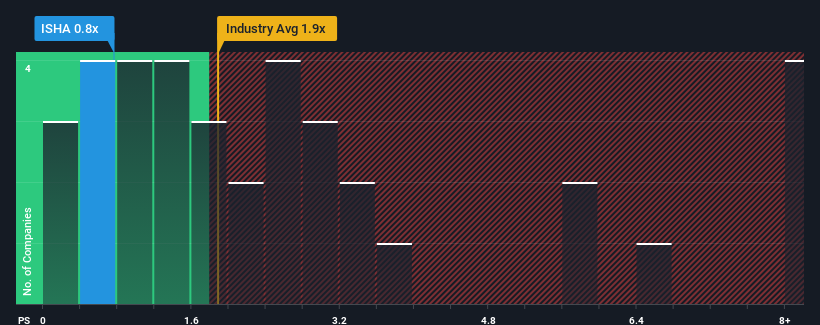

Although its price has surged higher, INTERSHOP Communications' price-to-sales (or "P/S") ratio of 0.8x might still make it look like a buy right now compared to the Software industry in Germany, where around half of the companies have P/S ratios above 1.9x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for INTERSHOP Communications

How Has INTERSHOP Communications Performed Recently?

Recent times haven't been great for INTERSHOP Communications as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on INTERSHOP Communications will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as INTERSHOP Communications' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. The latest three year period has also seen a 13% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.9% per year over the next three years. With the industry predicted to deliver 11% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that INTERSHOP Communications' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On INTERSHOP Communications' P/S

INTERSHOP Communications' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of INTERSHOP Communications' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for INTERSHOP Communications that you should be aware of.

If you're unsure about the strength of INTERSHOP Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether INTERSHOP Communications is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:ISHA

INTERSHOP Communications

INTERSHOP Communications Aktiengesellschaft offers B2B ecommerce solutions in Germany and internationally.

Undervalued with excellent balance sheet.