Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:APM

The Market Lifts Andean Precious Metals Corp. (CVE:APM) Shares 35% But It Can Do More

Andean Precious Metals Corp. (CVE:APM) shares have continued their recent momentum with a 35% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

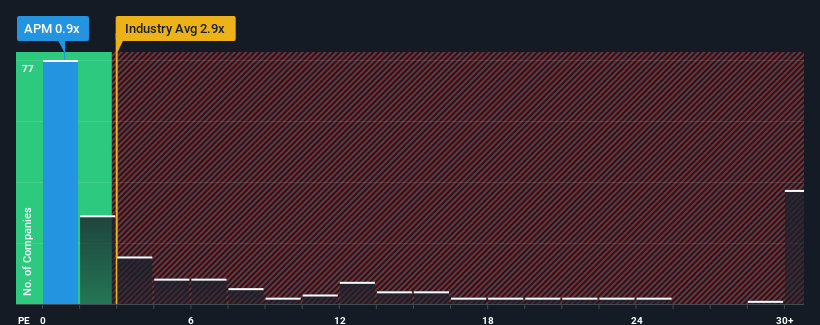

Although its price has surged higher, Andean Precious Metals' price-to-sales (or "P/S") ratio of 0.9x might still make it look like a strong buy right now compared to the wider Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 2.9x and even P/S above 16x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Andean Precious Metals

How Andean Precious Metals Has Been Performing

With revenue growth that's superior to most other companies of late, Andean Precious Metals has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Andean Precious Metals will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Andean Precious Metals?

The only time you'd be truly comfortable seeing a P/S as depressed as Andean Precious Metals' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 4.1% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 95% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this information, we find it odd that Andean Precious Metals is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Andean Precious Metals' P/S

Andean Precious Metals' recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Andean Precious Metals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Andean Precious Metals that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Andean Precious Metals is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:APM

Andean Precious Metals

Andean Precious Metals Corp. engages in the acquisition, exploration, development, and processing of mineral resource properties.

Undervalued with adequate balance sheet.