Stock Analysis

- Germany

- /

- Real Estate

- /

- XTRA:GTY

The five-year shareholder returns and company earnings persist lower as Gateway Real Estate (ETR:GTY) stock falls a further 12% in past week

Gateway Real Estate AG (ETR:GTY) shareholders should be happy to see the share price up 11% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 83% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Gateway Real Estate

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

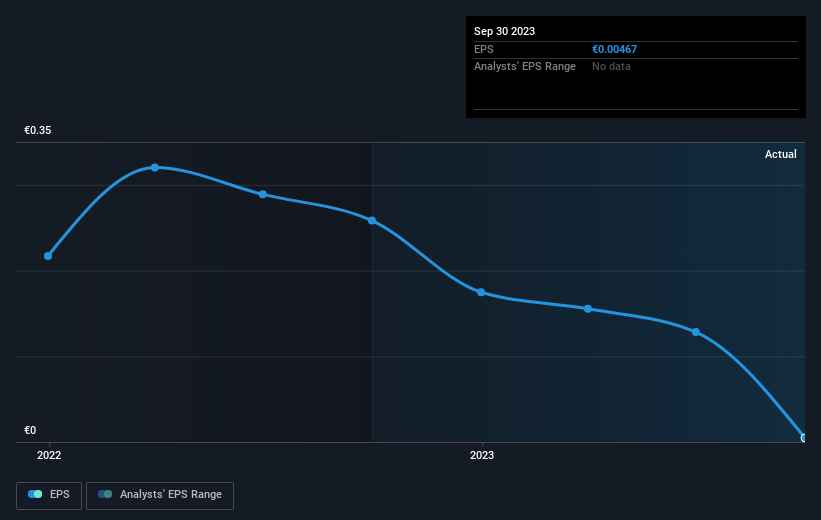

During the five years over which the share price declined, Gateway Real Estate's earnings per share (EPS) dropped by 35% each year. The impact of extraordinary items helps explain this. This change in EPS is reasonably close to the 30% average annual decrease in the share price. This suggests that market participants have not changed their view of the company all that much. So it's fair to say the share price has been responding to changes in EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Gateway Real Estate's key metrics by checking this interactive graph of Gateway Real Estate's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We've already covered Gateway Real Estate's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Gateway Real Estate's TSR, which was a 81% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Investors in Gateway Real Estate had a tough year, with a total loss of 78%, against a market gain of about 5.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 5 warning signs for Gateway Real Estate (2 are a bit concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Gateway Real Estate is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:GTY

Gateway Real Estate

Gateway Real Estate AG acquires, develops, rents, and sells commercial and residential properties in Germany.

Mediocre balance sheet with weak fundamentals.