Stock Analysis

- United Kingdom

- /

- Consumer Finance

- /

- AIM:RFX

Take Care Before Diving Into The Deep End On Ramsdens Holdings PLC (LON:RFX)

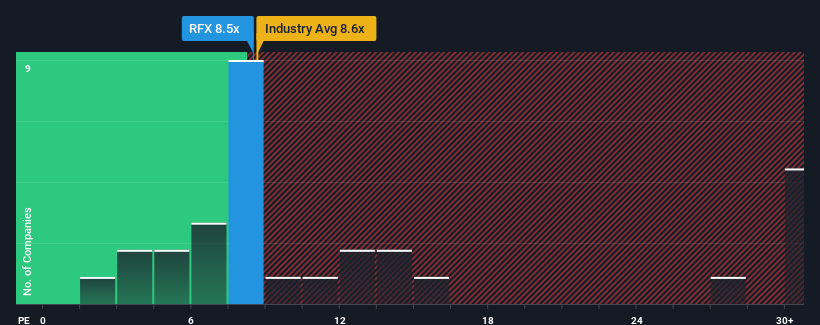

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 17x, you may consider Ramsdens Holdings PLC (LON:RFX) as an attractive investment with its 8.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

The earnings growth achieved at Ramsdens Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Ramsdens Holdings

Does Growth Match The Low P/E?

Ramsdens Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. Pleasingly, EPS has also lifted 59% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that Ramsdens Holdings is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Ramsdens Holdings' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Ramsdens Holdings currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Ramsdens Holdings, and understanding these should be part of your investment process.

You might be able to find a better investment than Ramsdens Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Ramsdens Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About AIM:RFX

Ramsdens Holdings

Ramsdens Holdings PLC engages in the provision of diversified financial services in the United Kingdom and internationally.

Excellent balance sheet with proven track record.