Stock Analysis

- Hong Kong

- /

- Energy Services

- /

- SEHK:1251

Subdued Growth No Barrier To SPT Energy Group Inc. (HKG:1251) With Shares Advancing 27%

SPT Energy Group Inc. (HKG:1251) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.4% in the last twelve months.

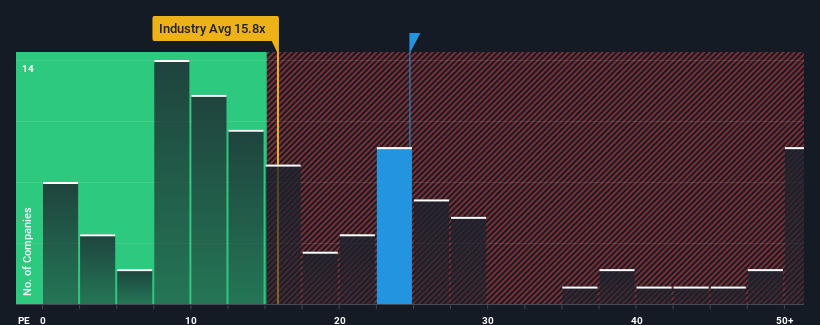

Since its price has surged higher, SPT Energy Group may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 24.7x, since almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

SPT Energy Group has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for SPT Energy Group

Is There Enough Growth For SPT Energy Group?

The only time you'd be truly comfortable seeing a P/E as steep as SPT Energy Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that SPT Energy Group is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has got SPT Energy Group's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of SPT Energy Group revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 3 warning signs for SPT Energy Group that you should be aware of.

Of course, you might also be able to find a better stock than SPT Energy Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether SPT Energy Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1251

SPT Energy Group

SPT Energy Group Inc., an investment holding company, provides integrated oilfield services; and manufactures and sells oilfield related products in the People's Republic of China, Kazakhstan, Turkmenistan, Canada, Singapore, Indonesia, the Middle East, and internationally.

Solid track record with adequate balance sheet.