Stock Analysis

- France

- /

- Consumer Durables

- /

- ENXTPA:ALHEX

Subdued Growth No Barrier To Hexaom S.A. (EPA:ALHEX) With Shares Advancing 29%

Hexaom S.A. (EPA:ALHEX) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

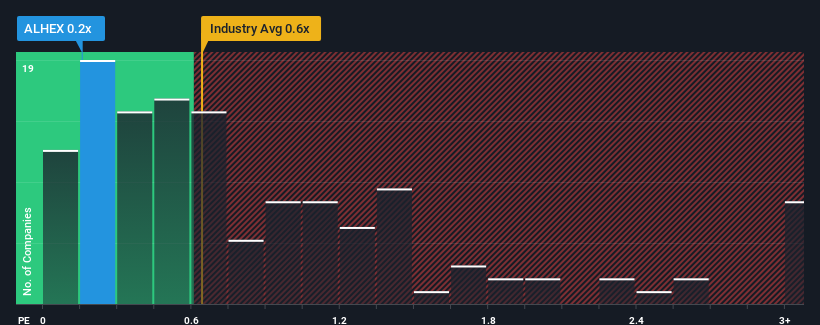

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hexaom's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in France is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Hexaom

How Has Hexaom Performed Recently?

The recently shrinking revenue for Hexaom has been in line with the industry. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hexaom.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Hexaom would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 3.4% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 16% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 25% as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.2%, which paints a poor picture.

With this information, we find it concerning that Hexaom is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Hexaom's P/S

Hexaom appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Hexaom's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Plus, you should also learn about this 1 warning sign we've spotted with Hexaom.

If you're unsure about the strength of Hexaom's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Hexaom is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTPA:ALHEX

Hexaom

Hexaom S.A. engages in the home building and renovation businesses in France.

Excellent balance sheet and fair value.