Stock Analysis

- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

Safran (EPA:SAF) shareholders have earned a 19% CAGR over the last three years

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Safran SA (EPA:SAF), which is up 64%, over three years, soundly beating the market return of 19% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 47% in the last year , including dividends .

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Safran

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Safran became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

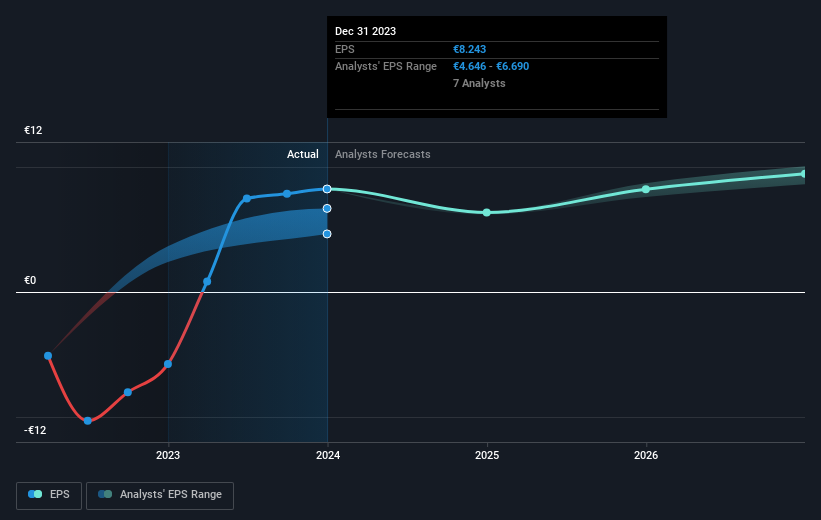

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Safran has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Safran's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Safran the TSR over the last 3 years was 67%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Safran shareholders have received a total shareholder return of 47% over the last year. And that does include the dividend. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before deciding if you like the current share price, check how Safran scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Safran is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:SAF

Good value with adequate balance sheet.