Stock Analysis

Österreichische Post AG's (VIE:POST) Share Price Not Quite Adding Up

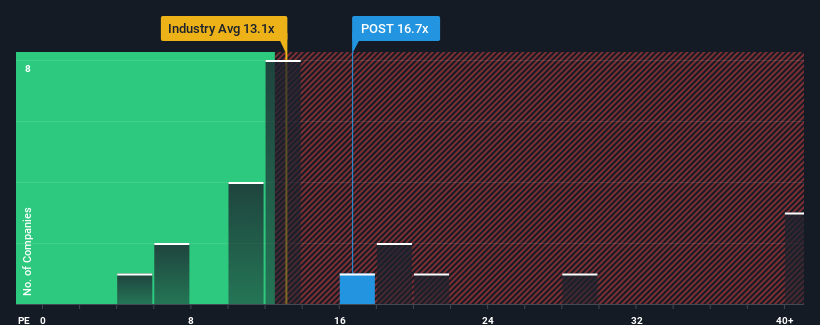

With a price-to-earnings (or "P/E") ratio of 16.7x Österreichische Post AG (VIE:POST) may be sending very bearish signals at the moment, given that almost half of all companies in Austria have P/E ratios under 8x and even P/E's lower than 6x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Österreichische Post's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Österreichische Post

Does Growth Match The High P/E?

Österreichische Post's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.1%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 11% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company are not good at all, suggesting earnings should decline by 7.4% over the next year. With the rest of the market predicted to shrink by 0.7%, it's a sub-optimal result.

In light of this, it's odd that Österreichische Post's P/E sits above the majority of other companies. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. There's strong potential for the P/E to fall to lower levels if the company doesn't improve its profitability.

What We Can Learn From Österreichische Post's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Österreichische Post's analyst forecasts revealed that its even shakier outlook against the market isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook, we suspect the share price is at risk of declining, sending the high P/E lower. In addition, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. Unless the company's prospects improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Österreichische Post you should know about.

If these risks are making you reconsider your opinion on Österreichische Post, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Österreichische Post is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WBAG:POST

Österreichische Post

Österreichische Post AG, together with its subsidiaries, provides postal and parcel services in Austria, Germany, Southeast and Eastern Europe, Türkiye, Azerbaijan, and internationally.

Good value with adequate balance sheet.