Stock Analysis

- Romania

- /

- Oil and Gas

- /

- BVB:SNG

SNGN Romgaz SA's (BVB:SNG) Shares Lagging The Market But So Is The Business

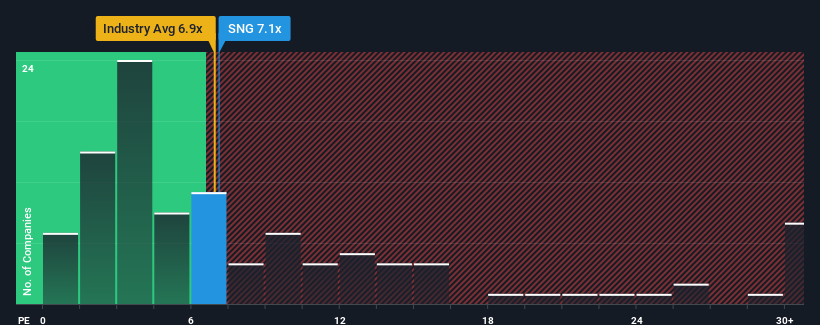

SNGN Romgaz SA's (BVB:SNG) price-to-earnings (or "P/E") ratio of 7.1x might make it look like a strong buy right now compared to the market in Romania, where around half of the companies have P/E ratios above 15x and even P/E's above 35x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, SNGN Romgaz has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for SNGN Romgaz

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like SNGN Romgaz's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. The latest three year period has also seen an excellent 125% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company are not good at all, suggesting earnings should decline by 15% per annum over the next three years. With the rest of the market predicted to shrink by 2.0% each year, it's a sub-optimal result.

With this information, it's not too hard to see why SNGN Romgaz is trading at a lower P/E in comparison. However, when earnings shrink rapidly the P/E often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From SNGN Romgaz's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of SNGN Romgaz's analyst forecasts revealed that its even shakier outlook against the market is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Although, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for SNGN Romgaz that you should be aware of.

You might be able to find a better investment than SNGN Romgaz. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether SNGN Romgaz is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:SNG

SNGN Romgaz

SNGN Romgaz SA explores for, produces, and supplies natural gas in Romania.

Undervalued with solid track record and pays a dividend.