Stock Analysis

- Brazil

- /

- Interactive Media and Services

- /

- BOVESPA:DOTZ3

Slammed 27% Dotz S.A. (BVMF:DOTZ3) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, Dotz S.A. (BVMF:DOTZ3) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 40% in that time.

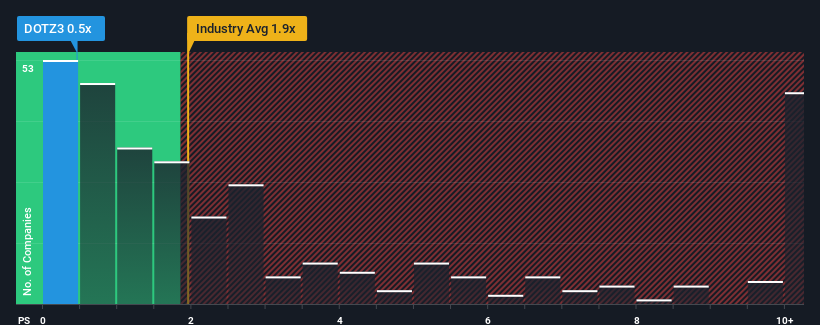

After such a large drop in price, Dotz's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Interactive Media and Services industry in Brazil, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Dotz

How Dotz Has Been Performing

Dotz could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Dotz will help you uncover what's on the horizon.How Is Dotz's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Dotz's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 25% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 30% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Dotz's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Dotz's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Dotz's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Dotz (at least 2 which are potentially serious), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Dotz is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:DOTZ3

Dotz

Dotz S.A., together with its subsidiaries, manages loyalty programs in Brazil.

Fair value with limited growth.