Stock Analysis

- United Arab Emirates

- /

- Basic Materials

- /

- ADX:APEX

Shareholders Should Be Pleased With Apex Investment PSC's (ADX:APEX) Price

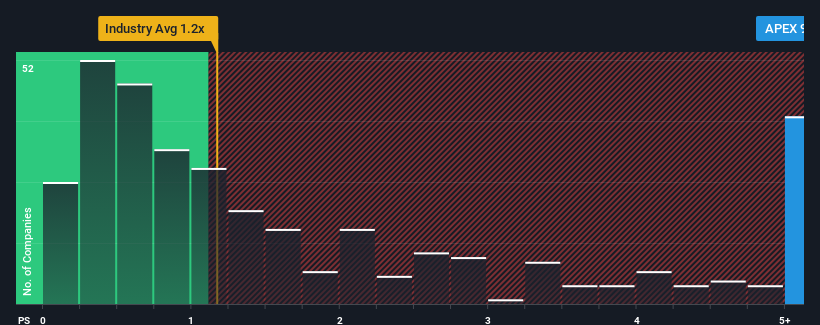

When close to half the companies in the Basic Materials industry in the United Arab Emirates have price-to-sales ratios (or "P/S") below 1.7x, you may consider Apex Investment PSC (ADX:APEX) as a stock to avoid entirely with its 9.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Apex Investment PSC

How Apex Investment PSC Has Been Performing

For example, consider that Apex Investment PSC's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Apex Investment PSC will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Apex Investment PSC would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

In contrast to the company, the rest of the industry is expected to decline by 1.8% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this in mind, it's clear to us why Apex Investment PSC's P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Apex Investment PSC's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Apex Investment PSC revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Apex Investment PSC with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Apex Investment PSC is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ADX:APEX

Apex Investment PSC

APEX Investment PSC manufactures, distributes, and sells clinkers and cement products in the United Arab Emirates and internationally.

Flawless balance sheet and slightly overvalued.