Stock Analysis

SBC Exports Limited's (NSE:SBC) P/S Is Still On The Mark Following 25% Share Price Bounce

SBC Exports Limited (NSE:SBC) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

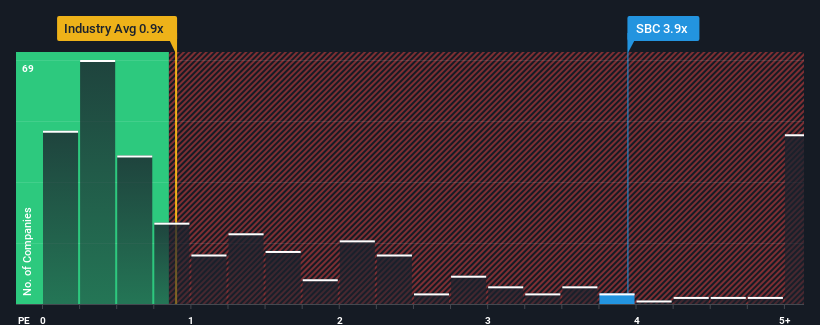

After such a large jump in price, given around half the companies in India's Luxury industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider SBC Exports as a stock to avoid entirely with its 3.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SBC Exports

What Does SBC Exports' P/S Mean For Shareholders?

The revenue growth achieved at SBC Exports over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SBC Exports' earnings, revenue and cash flow.How Is SBC Exports' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like SBC Exports' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 99% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in consideration, it's not hard to understand why SBC Exports' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does SBC Exports' P/S Mean For Investors?

SBC Exports' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that SBC Exports can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It is also worth noting that we have found 3 warning signs for SBC Exports (2 make us uncomfortable!) that you need to take into consideration.

If you're unsure about the strength of SBC Exports' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether SBC Exports is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SBC

SBC Exports

SBC Exports Limited manufactures and sells hosiery fabrics and garments in India.

Outstanding track record with adequate balance sheet.