Stock Analysis

- Hong Kong

- /

- Renewable Energy

- /

- SEHK:1071

Risks To Shareholder Returns Are Elevated At These Prices For Huadian Power International Corporation Limited (HKG:1071)

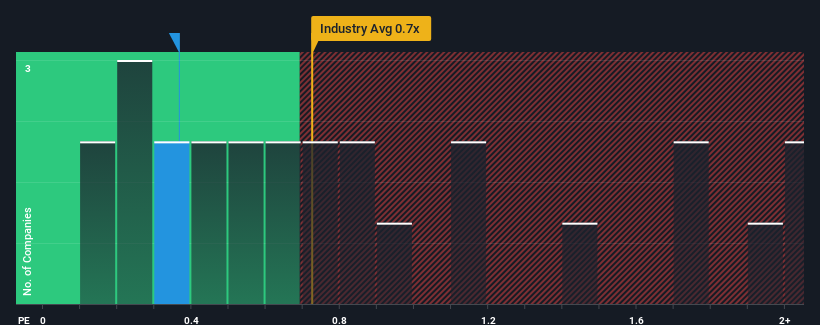

It's not a stretch to say that Huadian Power International Corporation Limited's (HKG:1071) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Renewable Energy industry in Hong Kong, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Huadian Power International

How Huadian Power International Has Been Performing

Recent times have been advantageous for Huadian Power International as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Huadian Power International will help you uncover what's on the horizon.How Is Huadian Power International's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Huadian Power International's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 9.5% gain to the company's revenues. The latest three year period has also seen a 26% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.8% each year as estimated by the eight analysts watching the company. That's shaping up to be materially lower than the 4.8% per annum growth forecast for the broader industry.

With this in mind, we find it intriguing that Huadian Power International's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Huadian Power International's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Huadian Power International's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Huadian Power International is showing 3 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Huadian Power International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Huadian Power International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1071

Huadian Power International

Huadian Power International Corporation Limited, together with its subsidiaries, engages in the generation and sale of electricity, heat, and coal to power grid companies in the People’s Republic of China.

Average dividend payer and fair value.