Stock Analysis

Rhone Ma Holdings Berhad (KLSE:RHONEMA) Will Pay A Dividend Of MYR0.01

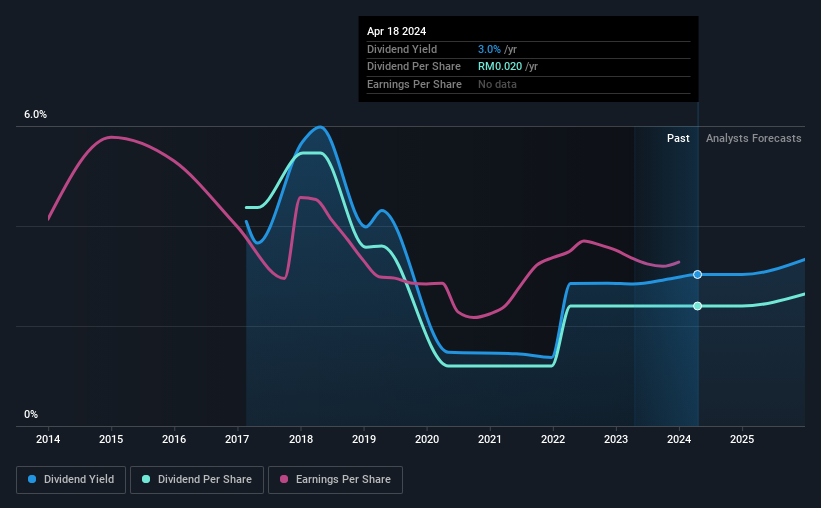

The board of Rhone Ma Holdings Berhad (KLSE:RHONEMA) has announced that it will pay a dividend on the 15th of July, with investors receiving MYR0.01 per share. This means the dividend yield will be fairly typical at 3.0%.

See our latest analysis for Rhone Ma Holdings Berhad

Rhone Ma Holdings Berhad's Dividend Is Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. But before making this announcement, Rhone Ma Holdings Berhad's earnings quite easily covered the dividend. The business is earning enough to make the dividend feasible, but the cash payout ratio of 87% shows that most of the cash is going back to the shareholders, which could constrain growth prospects going forward.

The next year is set to see EPS grow by 3.7%. Assuming the dividend continues along recent trends, we think the payout ratio could be 30% by next year, which is in a pretty sustainable range.

Rhone Ma Holdings Berhad's Dividend Has Lacked Consistency

It's comforting to see that Rhone Ma Holdings Berhad has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. The dividend has gone from an annual total of MYR0.0364 in 2017 to the most recent total annual payment of MYR0.02. This works out to be a decline of approximately 8.2% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Rhone Ma Holdings Berhad May Find It Hard To Grow The Dividend

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Unfortunately, Rhone Ma Holdings Berhad's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

Our Thoughts On Rhone Ma Holdings Berhad's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Rhone Ma Holdings Berhad's payments, as there could be some issues with sustaining them into the future. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Rhone Ma Holdings Berhad that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Rhone Ma Holdings Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:RHONEMA

Rhone Ma Holdings Berhad

Rhone Ma Holdings Berhad, an investment holding company, engages in the manufacture, trading, marketing, and distribution of animal health products primarily in Malaysia.

Excellent balance sheet second-rate dividend payer.