Stock Analysis

- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services Corporation's (NYSE:PRIM) P/E Still Appears To Be Reasonable

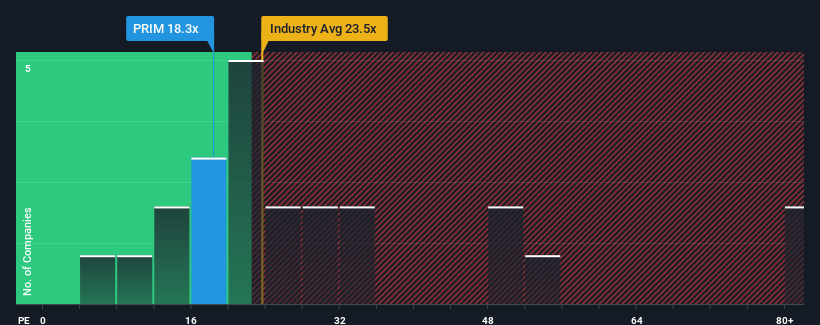

Primoris Services Corporation's (NYSE:PRIM) price-to-earnings (or "P/E") ratio of 18.3x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Primoris Services has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Primoris Services

Is There Enough Growth For Primoris Services?

There's an inherent assumption that a company should outperform the market for P/E ratios like Primoris Services' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.3%. Regardless, EPS has managed to lift by a handy 8.2% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 21% per annum as estimated by the five analysts watching the company. With the market only predicted to deliver 10% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Primoris Services is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Primoris Services' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Primoris Services, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Primoris Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Primoris Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRIM

Primoris Services

Primoris Services Corporation, a specialty contractor company, provides a range of specialty construction, fabrication, maintenance, replacement, and engineering services in the United States and Canada.

Undervalued with adequate balance sheet.