Stock Analysis

- United States

- /

- Capital Markets

- /

- NYSE:PX

P10, Inc. (NYSE:PX) Not Lagging Industry On Growth Or Pricing

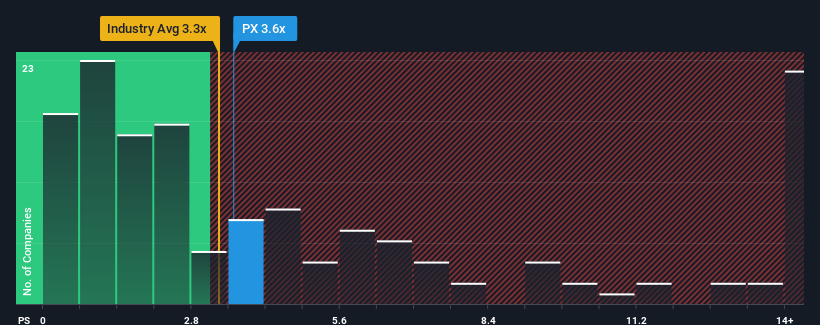

There wouldn't be many who think P10, Inc.'s (NYSE:PX) price-to-sales (or "P/S") ratio of 3.6x is worth a mention when the median P/S for the Capital Markets industry in the United States is similar at about 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for P10

What Does P10's P/S Mean For Shareholders?

Recent times have been advantageous for P10 as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think P10's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For P10?

In order to justify its P/S ratio, P10 would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 259% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.4% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 10% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's understandable that P10's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On P10's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that P10 maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 3 warning signs for P10 (of which 1 doesn't sit too well with us!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether P10 is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:PX

P10

P10, Inc., together with its subsidiaries, operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Reasonable growth potential and slightly overvalued.