Stock Analysis

- United States

- /

- Energy Services

- /

- NYSE:OIS

Oil States International, Inc.'s (NYSE:OIS) Shares Lagging The Industry But So Is The Business

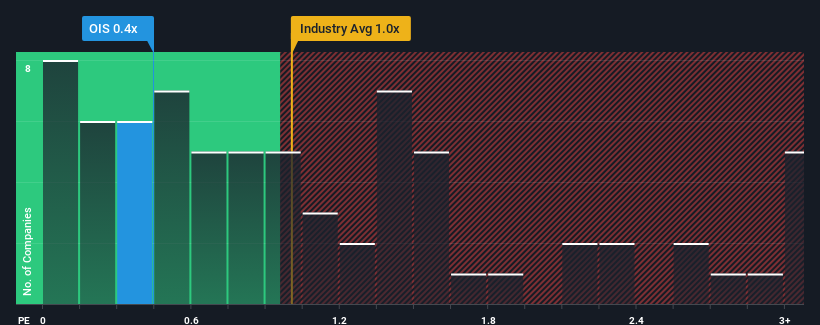

When you see that almost half of the companies in the Energy Services industry in the United States have price-to-sales ratios (or "P/S") above 1x, Oil States International, Inc. (NYSE:OIS) looks to be giving off some buy signals with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Oil States International

What Does Oil States International's Recent Performance Look Like?

Recent times haven't been great for Oil States International as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Oil States International will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Oil States International?

In order to justify its P/S ratio, Oil States International would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 6.0% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 23% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.0% per year over the next three years. That's shaping up to be materially lower than the 9.3% each year growth forecast for the broader industry.

In light of this, it's understandable that Oil States International's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Oil States International's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Oil States International's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Oil States International with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Oil States International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Oil States International, Inc., through its subsidiaries, provides engineered capital equipment and products for the energy, industrial, and military sectors worldwide.

Flawless balance sheet and undervalued.