Stock Analysis

- Singapore

- /

- Oil and Gas

- /

- SGX:AJ2

Not Many Are Piling Into Ouhua Energy Holdings Limited (SGX:AJ2) Just Yet

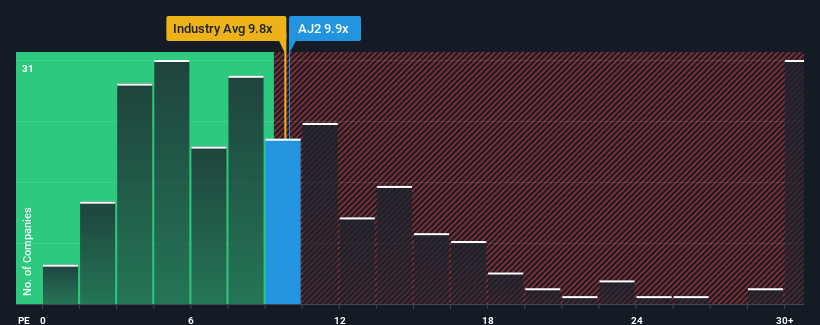

There wouldn't be many who think Ouhua Energy Holdings Limited's (SGX:AJ2) price-to-earnings (or "P/E") ratio of 9.9x is worth a mention when the median P/E in Singapore is similar at about 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Ouhua Energy Holdings over the last year, which is not ideal at all. One possibility is that the P/E is moderate because investors think the company might still do enough to be in line with the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Ouhua Energy Holdings

Is There Some Growth For Ouhua Energy Holdings?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ouhua Energy Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 60%. Still, the latest three year period has seen an excellent 82% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's noticeably more attractive on an annualised basis.

With this information, we find it interesting that Ouhua Energy Holdings is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ouhua Energy Holdings currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Ouhua Energy Holdings (1 doesn't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Ouhua Energy Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Ouhua Energy Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SGX:AJ2

Ouhua Energy Holdings

Ouhua Energy Holdings Limited, an investment holding company, engages in the production, import, processing, storage, and wholesale of liquefied petroleum gas (LPG) in the People’s Republic of China.

Mediocre balance sheet with questionable track record.