Stock Analysis

- Singapore

- /

- Real Estate

- /

- SGX:U14

Unveiling Three Premier Singapore Dividend Stocks Yielding Up To 7.6%

Reviewed by Kshitija Bhandaru

Amidst a landscape of fluctuating global markets, Singapore's economic resilience and strategic positioning continue to attract attention from investors seeking stability and growth. As we explore the appeal of dividend stocks in this vibrant market, it's essential to consider how these assets can serve as a cornerstone for portfolios, especially in times when steady income is prized.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 6.33% | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.77% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.63% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.69% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.52% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.40% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.34% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

| UMS Holdings (SGX:558) | 4.15% | ★★★★☆☆ |

| Sing Investments & Finance (SGX:S35) | 6.19% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

UMS Holdings (SGX:558)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UMS Holdings Limited is an investment holding company that specializes in manufacturing and marketing high precision front-end semiconductor components, alongside offering electromechanical assembly and final testing services, with a market capitalization of approximately SGD 959.22 million.

Operations: UMS Holdings Limited generates revenue primarily from its semiconductor segment, which brought in SGD 260.04 million, and its aerospace division, which contributed SGD 22.70 million.

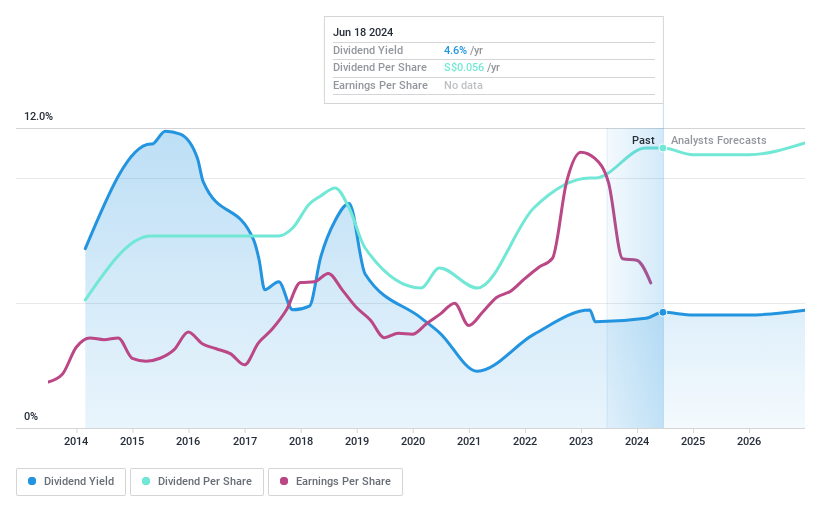

Dividend Yield: 4.1%

UMS Holdings is trading at 55.1% below its estimated fair value, with analysts predicting a 25.7% potential price increase. Despite a volatile dividend history over the past decade, the company maintains a reasonable payout ratio of 62.6%, ensuring dividends are covered by earnings and cash flows (cash payout ratio: 79.4%). However, its dividend yield of 4.15% is lower than the top quartile in Singapore's market at 6.27%. Recent board changes and proposed final dividends suggest ongoing governance adjustments and shareholder returns focus.

- Click here and access our complete dividend analysis report to understand the dynamics of UMS Holdings.

- In light of our recent valuation report, it seems possible that UMS Holdings is trading behind its estimated value.

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for use in concrete, serving markets in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally with a market capitalization of approximately SGD 570.65 million.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which brought in SGD 413.27 million, and Fabrication and Manufacturing, contributing SGD 1.21 billion.

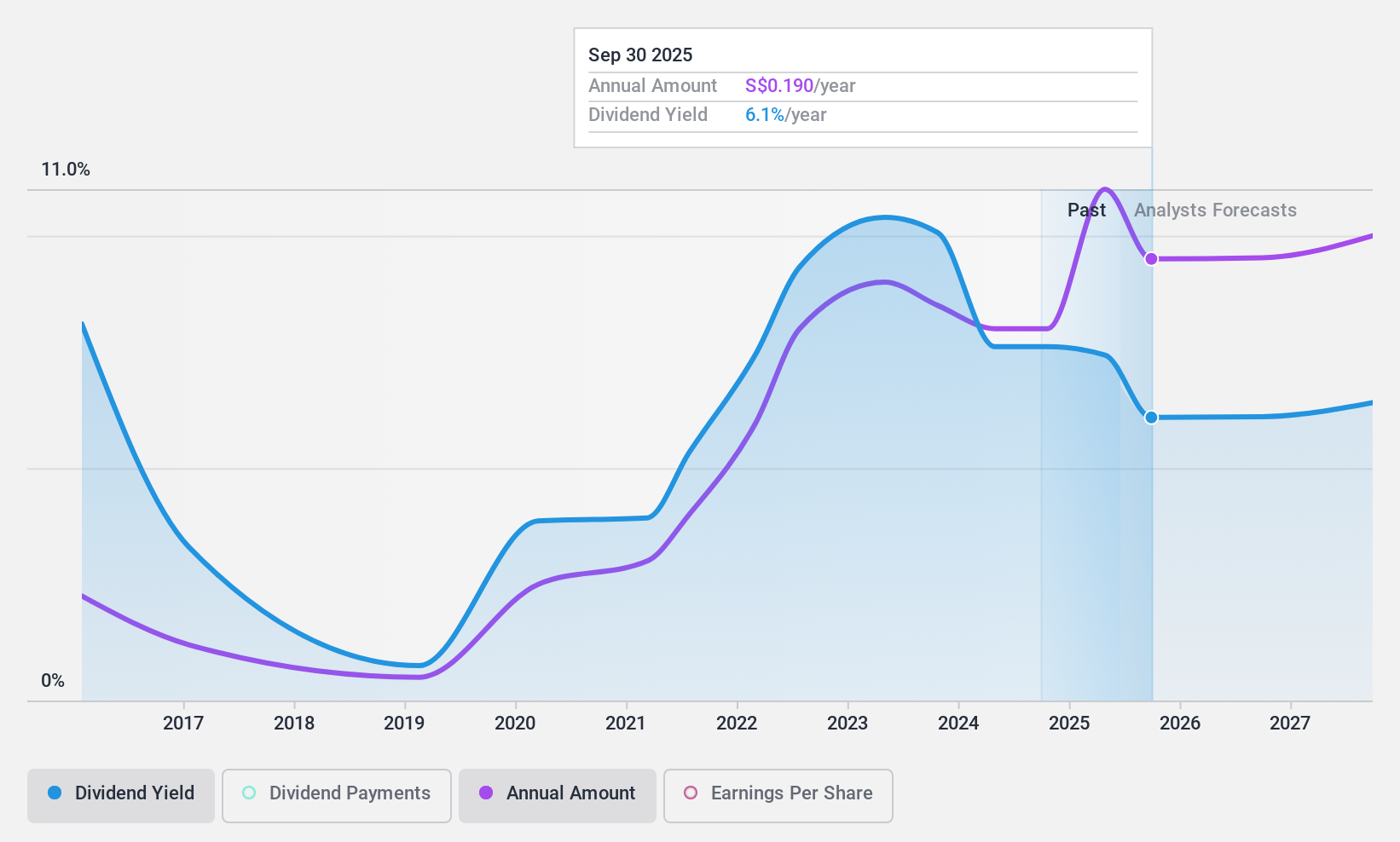

Dividend Yield: 7.7%

BRC Asia's dividend performance shows variability, with a history of fluctuating payments over the past decade. Despite this, recent dividends are covered by both earnings and cash flows, with payout ratios at 38% and 28.1% respectively, indicating a sustainable distribution level. The company recently declared both final and special dividends of S$0.055 per share for FY2023 during its AGM on January 31, 2024. However, it carries a high debt level which could impact future dividend reliability.

- Take a closer look at BRC Asia's potential here in our dividend report.

- According our valuation report, there's an indication that BRC Asia's share price might be on the cheaper side.

UOL Group (SGX:U14)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality across various countries including Singapore, Australia, the UK, and the US, with a market capitalization of approximately SGD 4.98 billion.

Operations: UOL Group Limited generates revenue primarily through property development in Singapore (SGD 1.16 billion), hotel operations in Singapore (SGD 464.93 million) and Australia (SGD 125.64 million), and property investments (SGD 518.93 million).

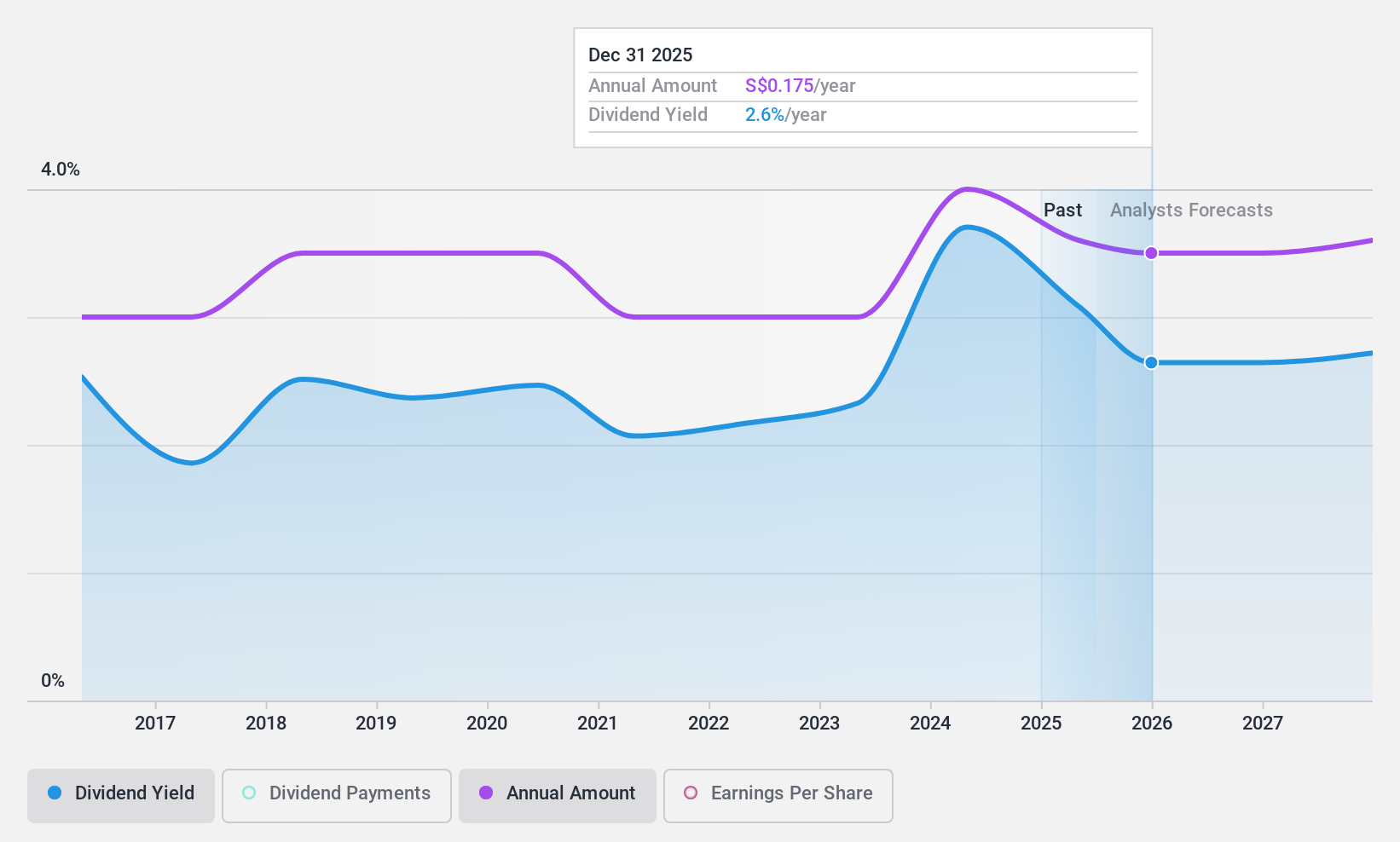

Dividend Yield: 3.4%

UOL Group Limited has seen a 43.9% increase in earnings over the past year, with its dividends well-covered by a low payout ratio of 17.9% and cash flows at 59.3%. Despite this strength, its dividend yield of 3.4% remains below the top quartile in Singapore's market. Recently, UOL announced a special dividend and affirmed annual dividends at its AGM on April 24, 2024, reflecting a commitment to shareholder returns despite forecasts of declining earnings over the next three years.

- Click to explore a detailed breakdown of our findings in UOL Group's dividend report.

- The valuation report we've compiled suggests that UOL Group's current price could be quite moderate.

Key Takeaways

- Discover the full array of 21 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether UOL Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U14

UOL Group

Engages in property and hospitality activities in Singapore, Australia, the United Kingdom, China, Malaysia, Indonesia, Thailand, Vietnam, Myanmar, Cambodia, Bangladesh, Japan, the United States, Canada, Kenya, and internationally.

Undervalued with excellent balance sheet and pays a dividend.