Stock Analysis

- Brazil

- /

- Consumer Services

- /

- BOVESPA:ANIM3

Ânima Holding S.A. (BVMF:ANIM3) May Have Run Too Fast Too Soon With Recent 27% Price Plummet

Ânima Holding S.A. (BVMF:ANIM3) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 51% in the last year.

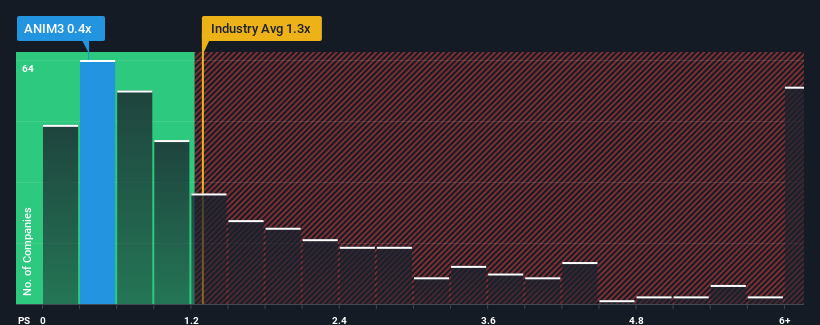

Although its price has dipped substantially, there still wouldn't be many who think Ânima Holding's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Brazil's Consumer Services industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Ânima Holding

What Does Ânima Holding's P/S Mean For Shareholders?

Recent times haven't been great for Ânima Holding as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Ânima Holding will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Ânima Holding?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ânima Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 163% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 5.1% per annum over the next three years. With the industry predicted to deliver 14% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Ânima Holding's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Ânima Holding looks to be in line with the rest of the Consumer Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Ânima Holding's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Ânima Holding is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Ânima Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:ANIM3

Ânima Holding

Ânima Holding S.A. operates as a education organization in Brazil.

Very undervalued with moderate growth potential.