Stock Analysis

- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NXSN

NextVision Stabilized Systems, Ltd. (TLV:NXSN) Not Flying Under The Radar

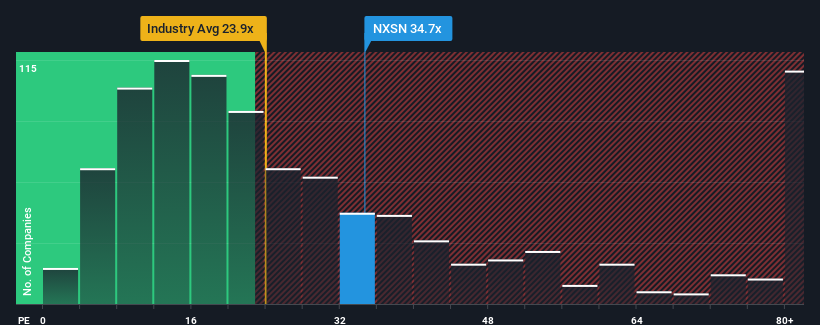

NextVision Stabilized Systems, Ltd.'s (TLV:NXSN) price-to-earnings (or "P/E") ratio of 34.7x might make it look like a strong sell right now compared to the market in Israel, where around half of the companies have P/E ratios below 12x and even P/E's below 7x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, NextVision Stabilized Systems has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for NextVision Stabilized Systems

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like NextVision Stabilized Systems' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 147% last year. The latest three year period has also seen an excellent 781% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why NextVision Stabilized Systems is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From NextVision Stabilized Systems' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that NextVision Stabilized Systems maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for NextVision Stabilized Systems (1 is concerning!) that you need to be mindful of.

Of course, you might also be able to find a better stock than NextVision Stabilized Systems. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether NextVision Stabilized Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TASE:NXSN

NextVision Stabilized Systems

NextVision Stabilized Systems, Ltd. develops, manufactures, and markets stabilized day and night cameras for ground and aerial vehicles.

Flawless balance sheet with acceptable track record.