Stock Analysis

- India

- /

- Metals and Mining

- /

- NSEI:NATIONALUM

National Aluminium Company Limited (NSE:NATIONALUM) Stock Rockets 31% But Many Are Still Ignoring The Company

National Aluminium Company Limited (NSE:NATIONALUM) shareholders have had their patience rewarded with a 31% share price jump in the last month. The annual gain comes to 124% following the latest surge, making investors sit up and take notice.

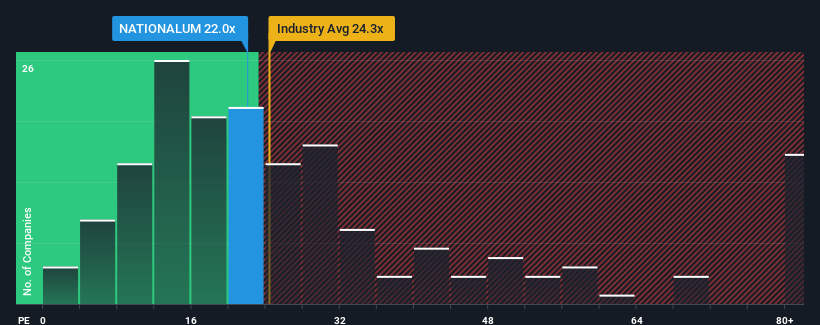

Even after such a large jump in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may still consider National Aluminium as an attractive investment with its 22x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

National Aluminium hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for National Aluminium

Does Growth Match The Low P/E?

National Aluminium's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 24%. Still, the latest three year period has seen an excellent 223% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 35% as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it odd that National Aluminium is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

National Aluminium's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that National Aluminium currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware National Aluminium is showing 1 warning sign in our investment analysis, you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether National Aluminium is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:NATIONALUM

National Aluminium

National Aluminium Company Limited manufactures and sells alumina and aluminum products in India and internationally.

Excellent balance sheet average dividend payer.