Stock Analysis

Moneysupermarket.com Group (LON:MONY) May Have Issues Allocating Its Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at Moneysupermarket.com Group (LON:MONY), they do have a high ROCE, but we weren't exactly elated from how returns are trending.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Moneysupermarket.com Group, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.36 = UK£97m ÷ (UK£405m - UK£138m) (Based on the trailing twelve months to December 2023).

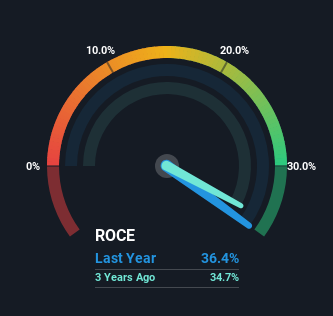

Thus, Moneysupermarket.com Group has an ROCE of 36%. In absolute terms that's a great return and it's even better than the Interactive Media and Services industry average of 16%.

Check out our latest analysis for Moneysupermarket.com Group

In the above chart we have measured Moneysupermarket.com Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Moneysupermarket.com Group .

The Trend Of ROCE

In terms of Moneysupermarket.com Group's historical ROCE movements, the trend isn't fantastic. To be more specific, while the ROCE is still high, it's fallen from 53% where it was five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. And if the increased capital generates additional returns, the business, and thus shareholders, will benefit in the long run.

The Key Takeaway

While returns have fallen for Moneysupermarket.com Group in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. However, despite the promising trends, the stock has fallen 27% over the last five years, so there might be an opportunity here for astute investors. As a result, we'd recommend researching this stock further to uncover what other fundamentals of the business can show us.

Moneysupermarket.com Group could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation for MONY on our platform quite valuable.

Moneysupermarket.com Group is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Valuation is complex, but we're helping make it simple.

Find out whether Moneysupermarket.com Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:MONY

Moneysupermarket.com Group

Moneysupermarket.com Group PLC, together with its subsidiaries, provides price comparison and lead generation services through its websites in the United Kingdom.

Very undervalued established dividend payer.