Stock Analysis

- Japan

- /

- Commercial Services

- /

- TSE:6182

MetaReal Corporation (TSE:6182) May Have Run Too Fast Too Soon With Recent 31% Price Plummet

MetaReal Corporation (TSE:6182) shares have had a horrible month, losing 31% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

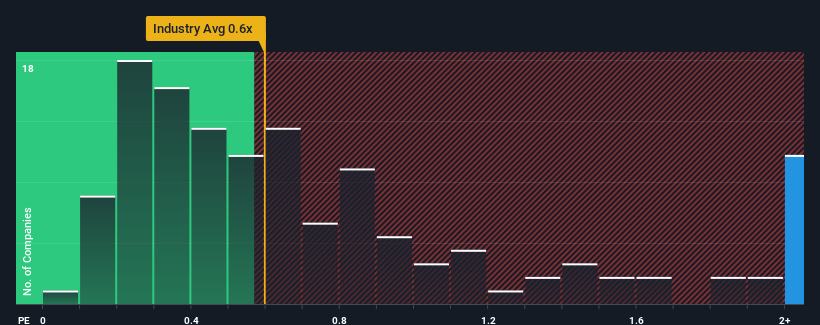

Even after such a large drop in price, you could still be forgiven for thinking MetaReal is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in Japan's Commercial Services industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for MetaReal

What Does MetaReal's P/S Mean For Shareholders?

For example, consider that MetaReal's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on MetaReal will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For MetaReal?

The only time you'd be truly comfortable seeing a P/S as steep as MetaReal's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 4.3% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that MetaReal's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does MetaReal's P/S Mean For Investors?

A significant share price dive has done very little to deflate MetaReal's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of MetaReal revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for MetaReal (1 is a bit concerning) you should be aware of.

If you're unsure about the strength of MetaReal's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether MetaReal is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6182

MetaReal

MetaReal Corporation develops, administers, and sells AI automatic translation services.

Outstanding track record with excellent balance sheet.