Stock Analysis

- South Africa

- /

- Capital Markets

- /

- JSE:PPE

Market Participants Recognise Purple Group Limited's (JSE:PPE) Revenues Pushing Shares 32% Higher

Purple Group Limited (JSE:PPE) shares have continued their recent momentum with a 32% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

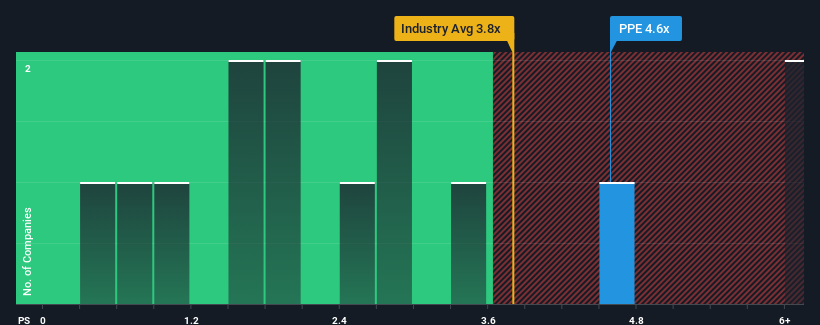

Since its price has surged higher, when almost half of the companies in South Africa's Capital Markets industry have price-to-sales ratios (or "P/S") below 2x, you may consider Purple Group as a stock not worth researching with its 4.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Purple Group

How Has Purple Group Performed Recently?

We'd have to say that with no tangible growth over the last year, Purple Group's revenue has been unimpressive. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Purple Group's earnings, revenue and cash flow.How Is Purple Group's Revenue Growth Trending?

In order to justify its P/S ratio, Purple Group would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 79% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

When compared to the industry's one-year growth forecast of 4.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Purple Group is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The strong share price surge has lead to Purple Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Purple Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Purple Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Purple Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:PPE

Purple Group

Purple Group Limited, a financial services and technology company, engages in trading platforms, fractional property and crypto asset investing, retirement fund administration, and asset management businesses in South Africa.

Adequate balance sheet with weak fundamentals.