Stock Analysis

- India

- /

- Electrical

- /

- NSEI:BHEL

Market Participants Recognise Bharat Heavy Electricals Limited's (NSE:BHEL) Revenues

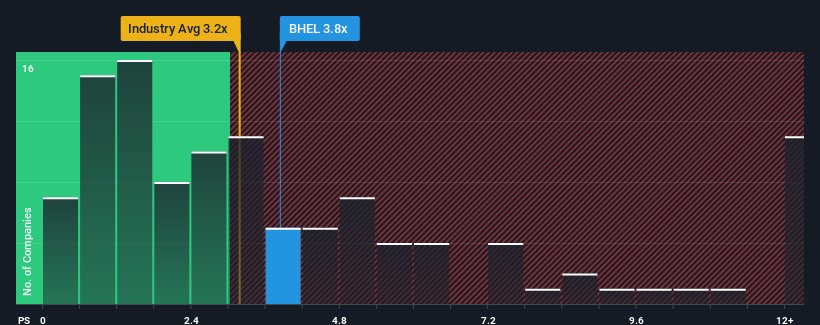

When close to half the companies in the Electrical industry in India have price-to-sales ratios (or "P/S") below 3.2x, you may consider Bharat Heavy Electricals Limited (NSE:BHEL) as a stock to potentially avoid with its 3.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Bharat Heavy Electricals

How Bharat Heavy Electricals Has Been Performing

Bharat Heavy Electricals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bharat Heavy Electricals.Is There Enough Revenue Growth Forecasted For Bharat Heavy Electricals?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Bharat Heavy Electricals' to be considered reasonable.

Retrospectively, the last year delivered a decent 2.8% gain to the company's revenues. The latest three year period has also seen an excellent 57% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 26% each year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 18% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Bharat Heavy Electricals is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Bharat Heavy Electricals' P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Bharat Heavy Electricals shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Bharat Heavy Electricals with six simple checks.

If you're unsure about the strength of Bharat Heavy Electricals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Bharat Heavy Electricals is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:BHEL

Bharat Heavy Electricals

Bharat Heavy Electricals Limited operates as engineering and manufacturing company in India.

Reasonable growth potential with mediocre balance sheet.