Stock Analysis

- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:LACR

LACROIX Group (EPA:LACR) Has Announced That Its Dividend Will Be Reduced To €0.70

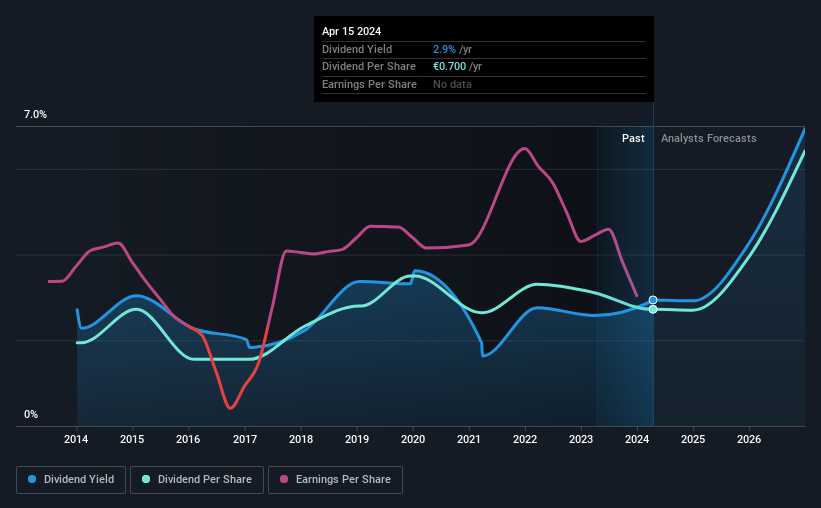

LACROIX Group SA (EPA:LACR) is reducing its dividend from last year's comparable payment to €0.70 on the 16th of July. The dividend yield of 2.9% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for LACROIX Group

LACROIX Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last payment made up 77% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Analysts expect a massive rise in earnings per share in the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 16%, which would make us comfortable with the dividend's sustainability, despite the levels currently being elevated.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was €0.50, compared to the most recent full-year payment of €0.70. This implies that the company grew its distributions at a yearly rate of about 3.4% over that duration. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though LACROIX Group's EPS has declined at around 19% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

In Summary

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 4 warning signs for LACROIX Group you should be aware of, and 1 of them makes us a bit uncomfortable. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether LACROIX Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTPA:LACR

LACROIX Group

LACROIX Group SA engages in the development, industrialization, production, and integration of electronic assemblies and subassemblies for the automotive, aeronautics, home automation, industrial, and healthcare sectors.

Average dividend payer with moderate growth potential.