Stock Analysis

- India

- /

- Metals and Mining

- /

- NSEI:JINDALSAW

Jindal Saw Limited (NSE:JINDALSAW) Surges 31% Yet Its Low P/E Is No Reason For Excitement

Jindal Saw Limited (NSE:JINDALSAW) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last month tops off a massive increase of 214% in the last year.

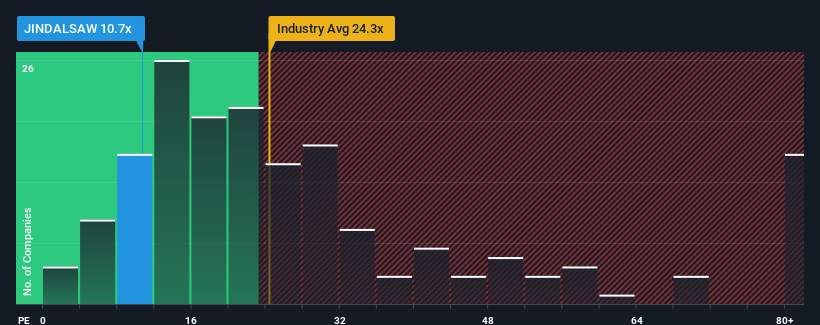

Even after such a large jump in price, Jindal Saw may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.7x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 58x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been advantageous for Jindal Saw as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Jindal Saw

How Is Jindal Saw's Growth Trending?

In order to justify its P/E ratio, Jindal Saw would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 276% gain to the company's bottom line. Pleasingly, EPS has also lifted 752% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 0.4% during the coming year according to the dual analysts following the company. With the market predicted to deliver 24% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Jindal Saw's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Jindal Saw's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jindal Saw maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Jindal Saw (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Jindal Saw is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:JINDALSAW

Jindal Saw

Jindal Saw Limited, together with its subsidiaries, engages in the manufacture and supply of iron and steel pipes, fittings, and accessories in India, the United States, Italy, the United Arab Emirates, and Algeria.

Solid track record with excellent balance sheet and pays a dividend.