Stock Analysis

- Spain

- /

- Real Estate

- /

- BME:REN

It's A Story Of Risk Vs Reward With Renta Corporación Real Estate, S.A. (BME:REN)

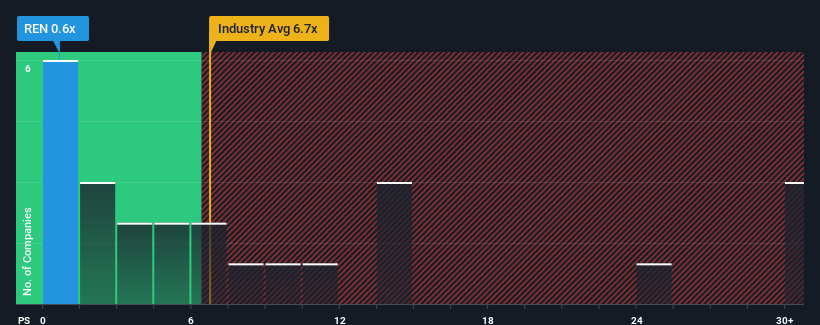

Renta Corporación Real Estate, S.A.'s (BME:REN) price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the Real Estate industry in Spain, where around half of the companies have P/S ratios above 6.7x and even P/S above 14x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Renta Corporación Real Estate

How Has Renta Corporación Real Estate Performed Recently?

As an illustration, revenue has deteriorated at Renta Corporación Real Estate over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Renta Corporación Real Estate, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Renta Corporación Real Estate's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. The last three years don't look nice either as the company has shrunk revenue by 6.1% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 5.7% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange but not a major surprise that Renta Corporación Real Estate is trading at a lower P/S in comparison. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares excessively.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look into numbers has shown it's somewhat unexpected that Renta Corporación Real Estate has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While recent medium-term revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You should always think about risks. Case in point, we've spotted 4 warning signs for Renta Corporación Real Estate you should be aware of, and 2 of them are a bit concerning.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Renta Corporación Real Estate is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BME:REN

Renta Corporación Real Estate

Renta Corporación Real Estate, S.A., a real estate company, engages in the acquisition, refurbishment, and sale of real estate properties in the cities of Barcelona and Madrid, Spain.

Mediocre balance sheet and slightly overvalued.