Stock Analysis

There are a few key trends to look for if we want to identify the next multi-bagger. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in Oceanus Group's (SGX:579) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Oceanus Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.047 = S$4.5m ÷ (S$187m - S$92m) (Based on the trailing twelve months to December 2023).

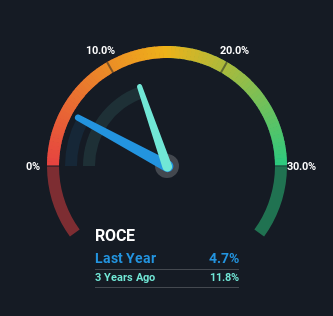

Therefore, Oceanus Group has an ROCE of 4.7%. Ultimately, that's a low return and it under-performs the Food industry average of 7.4%.

View our latest analysis for Oceanus Group

Historical performance is a great place to start when researching a stock so above you can see the gauge for Oceanus Group's ROCE against it's prior returns. If you're interested in investigating Oceanus Group's past further, check out this free graph covering Oceanus Group's past earnings, revenue and cash flow.

What Can We Tell From Oceanus Group's ROCE Trend?

The fact that Oceanus Group is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 4.7% on its capital. And unsurprisingly, like most companies trying to break into the black, Oceanus Group is utilizing 249% more capital than it was five years ago. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. The current liabilities has increased to 49% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. And with current liabilities at those levels, that's pretty high.

The Bottom Line

In summary, it's great to see that Oceanus Group has managed to break into profitability and is continuing to reinvest in its business. Since the stock has returned a staggering 200% to shareholders over the last five years, it looks like investors are recognizing these changes. In light of that, we think it's worth looking further into this stock because if Oceanus Group can keep these trends up, it could have a bright future ahead.

On a separate note, we've found 3 warning signs for Oceanus Group you'll probably want to know about.

While Oceanus Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're helping make it simple.

Find out whether Oceanus Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SGX:579

Oceanus Group

Oceanus Group Limited, an investment holding company, sells processed marine products, sugar, beverages, and other commodities in Singapore, Hong Kong, Macau, Thailand, and the People’s Republic of China.

Adequate balance sheet and overvalued.