Stock Analysis

- Canada

- /

- Energy Services

- /

- TSX:HWO

Investors Still Waiting For A Pull Back In High Arctic Energy Services Inc (TSE:HWO)

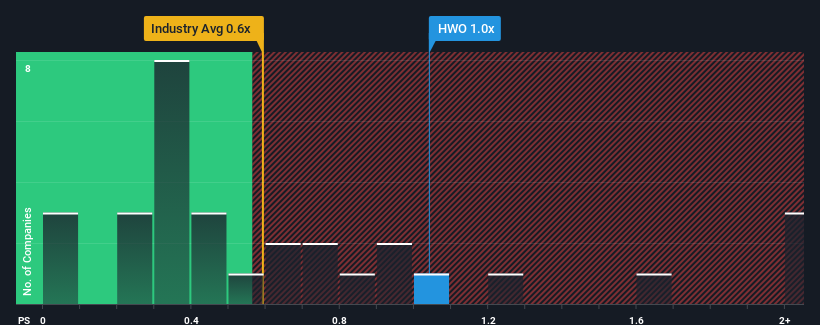

There wouldn't be many who think High Arctic Energy Services Inc's (TSE:HWO) price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S for the Energy Services industry in Canada is similar at about 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for High Arctic Energy Services

What Does High Arctic Energy Services' Recent Performance Look Like?

For instance, High Arctic Energy Services' receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on High Arctic Energy Services' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For High Arctic Energy Services?

In order to justify its P/S ratio, High Arctic Energy Services would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. As a result, revenue from three years ago have also fallen 36% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It turns out the industry is also predicted to shrink 15% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

With this in mind, it's no surprise that High Arctic Energy Services' P/S is similar to its industry peers. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down in unison. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does High Arctic Energy Services' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of High Arctic Energy Services revealed its three-year contraction in revenue is resulting in a P/S that matches the industry, given the industry is also set to shrink at a similar rate. At this stage investors feel the company's revenue potential is similar enough to its peers that it doesn't warrant a higher or lower P/S. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction unless there's a material change to operating conditions.

Plus, you should also learn about these 3 warning signs we've spotted with High Arctic Energy Services (including 2 which are concerning).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether High Arctic Energy Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HWO

High Arctic Energy Services

High Arctic Energy Services Inc., an oilfield services company, provides oilfield services to exploration and production companies in Canada and Papua New Guinea.

Excellent balance sheet and fair value.