Stock Analysis

Investors Interested In Atlas Pearls Limited's (ASX:ATP) Revenues

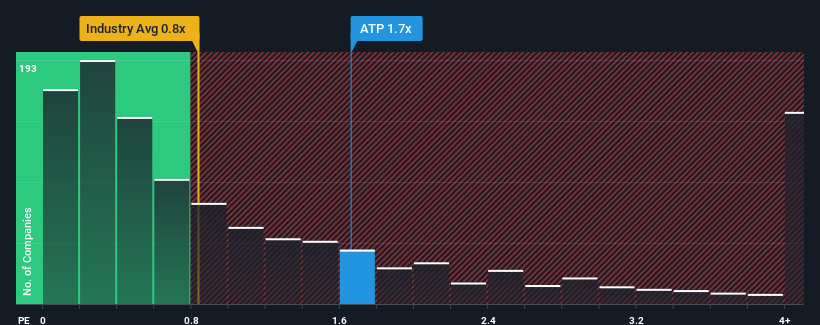

When close to half the companies in the Luxury industry in Australia have price-to-sales ratios (or "P/S") below 0.8x, you may consider Atlas Pearls Limited (ASX:ATP) as a stock to potentially avoid with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Atlas Pearls

What Does Atlas Pearls' P/S Mean For Shareholders?

Recent times have been quite advantageous for Atlas Pearls as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Atlas Pearls' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Atlas Pearls?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Atlas Pearls' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 92%. The latest three year period has also seen an excellent 225% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 7.5% shows it's noticeably more attractive.

With this information, we can see why Atlas Pearls is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Atlas Pearls' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Atlas Pearls revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you take the next step, you should know about the 4 warning signs for Atlas Pearls (1 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of Atlas Pearls' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Atlas Pearls is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ATP

Atlas Pearls

Atlas Pearls Limited produces and sells south sea pearls in Australia and Indonesia.

Flawless balance sheet with solid track record.