Stock Analysis

- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:UTDI

Investors Holding Back On United Internet AG (ETR:UTDI)

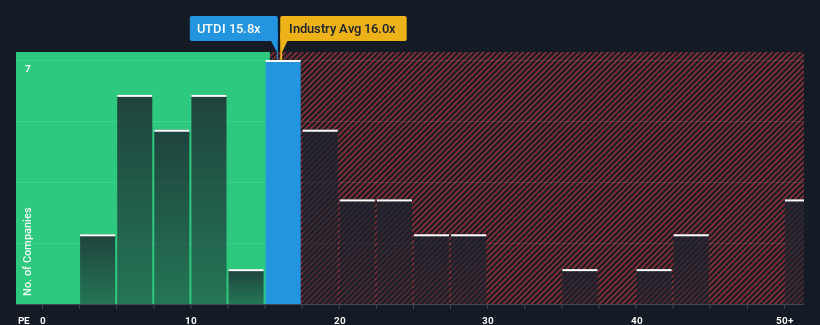

With a median price-to-earnings (or "P/E") ratio of close to 17x in Germany, you could be forgiven for feeling indifferent about United Internet AG's (ETR:UTDI) P/E ratio of 15.8x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for United Internet as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for United Internet

Does Growth Match The P/E?

In order to justify its P/E ratio, United Internet would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. The last three years don't look nice either as the company has shrunk EPS by 13% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 23% per annum as estimated by the twelve analysts watching the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that United Internet's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of United Internet's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for United Internet that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether United Internet is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:UTDI

United Internet

United Internet AG, through its subsidiaries, operates as an Internet service provider worldwide.

Fair value second-rate dividend payer.