Stock Analysis

- Germany

- /

- Semiconductors

- /

- XTRA:WAF

Investors Don't See Light At End Of Siltronic AG's (ETR:WAF) Tunnel

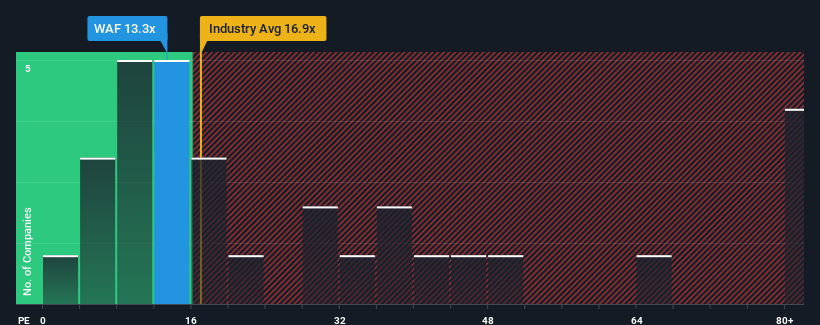

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") above 18x, you may consider Siltronic AG (ETR:WAF) as an attractive investment with its 13.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Siltronic has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Siltronic

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Siltronic's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 53%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 7.5% each year during the coming three years according to the ten analysts following the company. That's not great when the rest of the market is expected to grow by 14% each year.

With this information, we are not surprised that Siltronic is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Siltronic's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Siltronic's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Siltronic (2 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Siltronic is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About XTRA:WAF

Siltronic

Siltronic AG, together with its subsidiaries, provides hyperpure semiconductor silicon wafers in Germany, rest of Europe, the United States, Taiwan and Mainland China, Korea, and Rest of Asia.

Undervalued with adequate balance sheet.