Stock Analysis

- South Africa

- /

- Food

- /

- JSE:TBS

Investor Optimism Abounds Tiger Brands Limited (JSE:TBS) But Growth Is Lacking

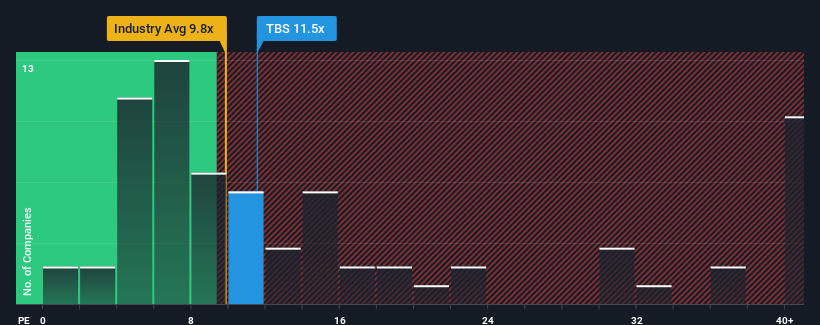

With a price-to-earnings (or "P/E") ratio of 11.5x Tiger Brands Limited (JSE:TBS) may be sending bearish signals at the moment, given that almost half of all companies in South Africa have P/E ratios under 8x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Tiger Brands could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Tiger Brands

Does Growth Match The High P/E?

Tiger Brands' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 2.1% decrease to the company's bottom line. Even so, admirably EPS has lifted 95% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 6.6% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% each year, which is noticeably more attractive.

With this information, we find it concerning that Tiger Brands is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Tiger Brands' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tiger Brands' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Tiger Brands that you need to take into consideration.

If these risks are making you reconsider your opinion on Tiger Brands, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Tiger Brands is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About JSE:TBS

Tiger Brands

Tiger Brands Limited engages in the manufacture and sale of fast-moving consumer goods in South Africa.

Excellent balance sheet second-rate dividend payer.