Stock Analysis

Ramco Systems Limited (NSE:RAMCOSYS) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 81% in the last year.

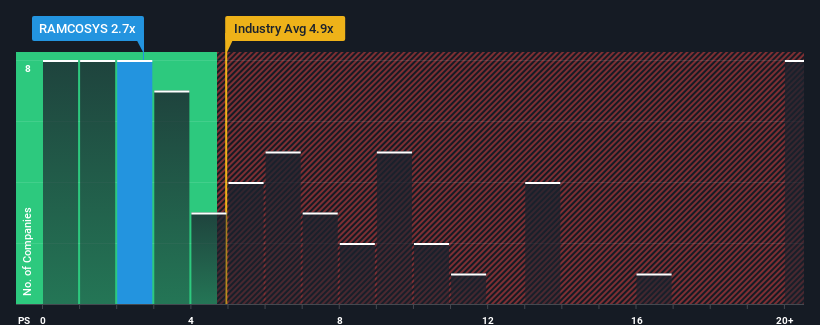

Although its price has surged higher, Ramco Systems may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.7x, since almost half of all companies in the Software industry in India have P/S ratios greater than 4.9x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Ramco Systems

How Has Ramco Systems Performed Recently?

With revenue growth that's inferior to most other companies of late, Ramco Systems has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ramco Systems' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ramco Systems' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 15% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.1% as estimated by the lone analyst watching the company. With the industry predicted to deliver 18% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Ramco Systems' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Despite Ramco Systems' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Ramco Systems' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ramco Systems you should be aware of, and 1 of them can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Ramco Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NSEI:RAMCOSYS

Ramco Systems

Ramco Systems Limited operates as an enterprise software company in the Americas, Europe, the Asia-Pacific, India, and the Middle East, and Africa.

Slightly overvalued with imperfect balance sheet.