Stock Analysis

- Sweden

- /

- Medical Equipment

- /

- OM:SUS

Here's Why Surgical Science Sweden (STO:SUS) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Surgical Science Sweden (STO:SUS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Surgical Science Sweden with the means to add long-term value to shareholders.

View our latest analysis for Surgical Science Sweden

Surgical Science Sweden's Improving Profits

Over the last three years, Surgical Science Sweden has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Surgical Science Sweden's EPS has risen over the last 12 months, growing from kr3.70 to kr4.59. That's a 24% gain; respectable growth in the broader scheme of things.

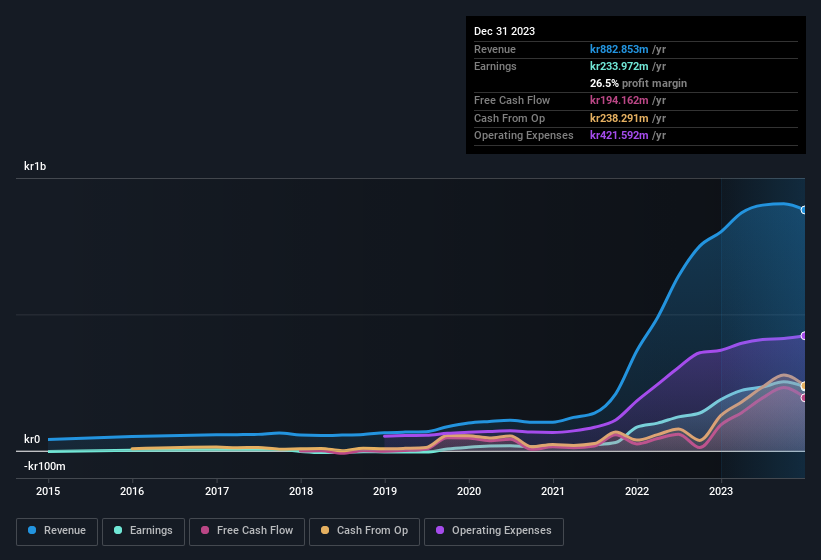

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Surgical Science Sweden remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 10% to kr883m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Surgical Science Sweden's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Surgical Science Sweden Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Surgical Science Sweden insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at kr2.5b. This totals to 31% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Surgical Science Sweden with market caps between kr4.4b and kr17b is about kr8.1m.

The Surgical Science Sweden CEO received kr5.2m in compensation for the year ending December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Surgical Science Sweden Worth Keeping An Eye On?

One positive for Surgical Science Sweden is that it is growing EPS. That's nice to see. The growth of EPS may be the eye-catching headline for Surgical Science Sweden, but there's more to bring joy for shareholders. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. Now, you could try to make up your mind on Surgical Science Sweden by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in SE with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Surgical Science Sweden is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About OM:SUS

Surgical Science Sweden

Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

Flawless balance sheet and undervalued.