Stock Analysis

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Medibank Private (ASX:MPL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Medibank Private

How Quickly Is Medibank Private Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Impressively, Medibank Private has grown EPS by 24% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

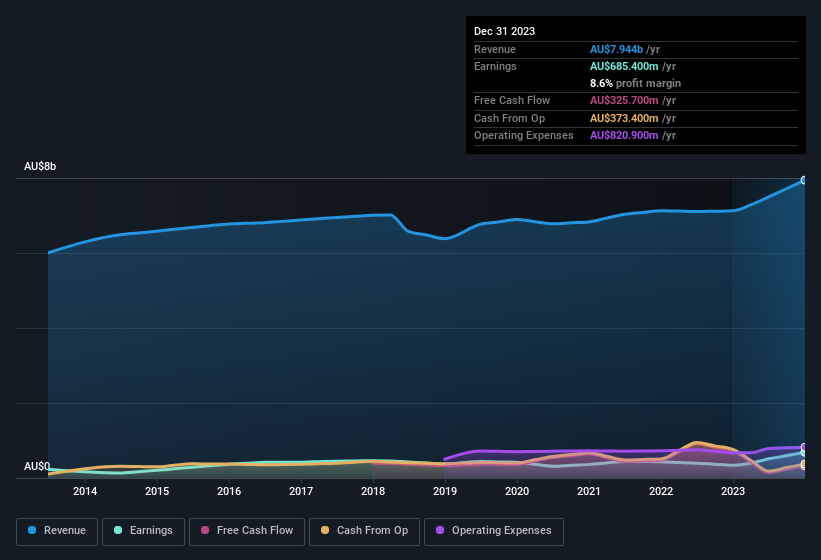

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Medibank Private shareholders can take confidence from the fact that EBIT margins are up from 6.8% to 12%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Medibank Private's future profits.

Are Medibank Private Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Medibank Private shares, in the last year. With that in mind, it's heartening that Linda Nicholls, the Independent Non-Executive Director of the company, paid AU$20k for shares at around AU$3.65 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

It's reassuring that Medibank Private insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. For companies with market capitalisations between AU$6.2b and AU$19b, like Medibank Private, the median CEO pay is around AU$4.2m.

Medibank Private offered total compensation worth AU$3.3m to its CEO in the year to June 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Medibank Private To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Medibank Private's strong EPS growth. To add to the positives, Medibank Private has recorded instances of insider buying and a modest executive pay to boot. On balance the message seems to be that this stock is worth looking at, at least for a while. What about risks? Every company has them, and we've spotted 2 warning signs for Medibank Private (of which 1 can't be ignored!) you should know about.

The good news is that Medibank Private is not the only growth stock with insider buying. Here's a list of growth-focused companies in AU with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Medibank Private is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ASX:MPL

Medibank Private

Medibank Private Limited provides private health insurance and health services in Australia.

Outstanding track record with flawless balance sheet.