Stock Analysis

Here's Why Aurangabad Distillery (NSE:AURDIS) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Aurangabad Distillery (NSE:AURDIS), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Aurangabad Distillery

Aurangabad Distillery's Improving Profits

Over the last three years, Aurangabad Distillery has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Aurangabad Distillery's EPS shot from ₹13.25 to ₹24.49, over the last year. It's not often a company can achieve year-on-year growth of 85%. That could be a sign that the business has reached a true inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that Aurangabad Distillery is growing revenues, and EBIT margins improved by 4.3 percentage points to 23%, over the last year. That's great to see, on both counts.

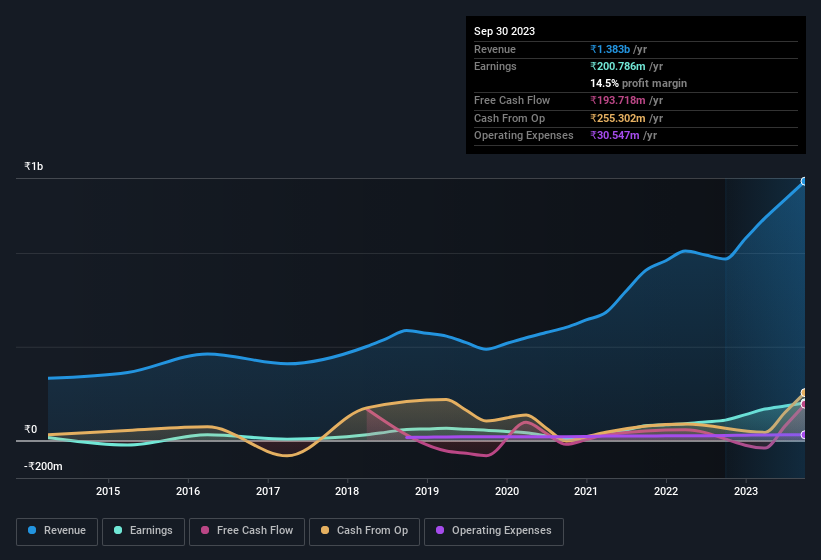

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Aurangabad Distillery is no giant, with a market capitalisation of ₹2.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Aurangabad Distillery Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Aurangabad Distillery insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 75% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about ₹1.7b riding on the stock, at current prices. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations under ₹17b, like Aurangabad Distillery, the median CEO pay is around ₹3.3m.

Aurangabad Distillery's CEO only received compensation totalling ₹2.4m in the year to March 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Aurangabad Distillery To Your Watchlist?

Aurangabad Distillery's earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Aurangabad Distillery is certainly doing some things right and is well worth investigating. It is worth noting though that we have found 3 warning signs for Aurangabad Distillery that you need to take into consideration.

Although Aurangabad Distillery certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Indian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Aurangabad Distillery is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AURDIS

Aurangabad Distillery

Aurangabad Distillery Limited engages in the manufacture and sale of rectified spirits, denatured spirits, and extra neutral alcohols in India.

Outstanding track record and good value.